Blog

Westfield Bank CD Rates: Maximize Your Savings with Competitive Interest Options

Understanding Westfield Bank CD Rates

Westfield Bank CD Rates: Investing your money wisely is essential for building a secure financial future. One popular option for conservative investors is a Certificate of Deposit (CD).

Westfield Bank provides attractive CD rates for those seeking stable returns on savings. This article explores Westfield Bank’s CD rates and how they compare to other financial institutions.

What is a Certificate of Deposit?

A Certificate of Deposit is a bank savings product with a fixed interest rate for a set term. CDs involve depositing a lump sum for a fixed period, from months to years.

Banks provide higher interest rates for keeping your money untouched compared to traditional savings accounts. However, withdrawing funds before the maturity date can lead to penalties.

Westfield Bank CD Rates Overview

Westfield Bank is known for its competitive CD rates and flexible terms. They offer various CD options to cater to different financial goals and timelines. Here are some key features of Westfield Bank’s CD offerings:

- Competitive Interest Rates: Westfield Bank offers competitive interest rates above the national average.

- This ensures your money grows effectively over time.

- Flexible Terms: Westfield Bank offers investment terms from a few months to several years, suitable for both short-term and long-term strategies.

- Low Minimum Deposit Requirements: Westfield Bank offers accessible CDs for entry-level investors with modest initial deposits.

Factors to Consider When Choosing a CD

When selecting a CD, it’s crucial to consider several factors to ensure it aligns with your financial goals:

- Interest Rate: Compare bank rates to maximize investment returns.

- Westfield Bank often ranks highly in rate comparisons.

- Term Length: Longer terms mean higher interest rates, but require a lengthy commitment.

- Consider your liquidity needs before committing.

- Early Withdrawal Penalties: Be aware that early withdrawal penalties can greatly affect your earnings if you access funds before maturity.

- FDIC Insurance: Choose an FDIC-insured bank to protect deposits up to $250,000 against bank failure.

How Westfield Bank Compares

Compared to other financial institutions, Westfield Bank’s CD rates are competitive. A recent Bankrate survey found Westfield Bank’s rates consistently above the national average, making it a strong option for maximizing earnings on a safe investment.

Additionally, Westfield Bank’s customer service and accessibility make it a preferred choice for many. Their online banking platform offers convenient CD management and easy account access for customer peace of mind.

Westfield Bank’s CD rates offer

Westfield Bank’s CD rates offer a reliable and profitable option for savers seeking higher returns on their deposits. Understand key factors and compare options to choose a CD that fits your financial goals.

Westfield Bank offers competitive rates, flexible terms, and great customer service, making it a top choice for Certificate of Deposit investments.

10 Key Points About Westfield Bank CD Rates

- Variety of Terms: Westfield Bank offers CDs with various term lengths, allowing investors to choose from a few months to several years based on their investment strategy.

- Competitive Rates: Interest rates on Westfield Bank CDs are often above the national average, providing an opportunity for higher returns compared to many other financial institutions.

- Low Initial Deposit: With low minimum deposit requirements, Westfield Bank makes it easy for more individuals to start investing in CDs.

- Automatic Renewal: Westfield Bank provides an automatic renewal feature for CDs, which can be convenient for investors looking to maintain their investment strategy.

Interest Compound Frequency

- Interest Compound Frequency: Westfield Bank CDs compound interest regularly, boosting investment growth.

- No Monthly Fees: Westfield Bank CDs avoid monthly fees, protecting your returns from unnecessary costs.

- Easy Online Access: The bank’s digital platform enables customers to easily manage their CDs online, providing convenient access to account details and transactions.

- Early Withdrawal Options: Understanding early withdrawal terms can help avoid penalties and access funds under certain conditions.

- FDIC-Insured: Westfield Bank CDs are FDIC-insured up to $250,000, offering a secure investment.

- Community Oriented: Westfield Bank reinvests in the community, appealing to investors who support local economic growth.

Experts Advise on Westfield Bank CD Rates

Experts recommend Westfield Bank CD rates as a low-risk option for savings growth. It’s important to understand CD terms like interest rates, durations, and early withdrawal penalties to match financial strategies.

Experts recommend comparing Westfield Bank CD rates and terms with other institutions to make informed choices.

Westfield Bank offers flexible savings options with low minimum deposits and automatic renewals, ideal for ongoing investment strategies.

Careful assessment helps investors maximize returns and benefit from FDIC insurance security.

Compelling Example of Westfield Bank CD Rates in Action

Imagine Jane, a diligent saver looking to optimize her investment returns without taking significant risks. Jane chooses to explore Westfield Bank’s CDs due to their competitive interest rates and flexible term lengths.

Jane chooses to invest $10,000 in a 5-year CD with Westfield Bank at a competitive rate of 3.5% APY. Westfield Bank compounds the interest quarterly, enhancing the growth potential of her investment. Jane’s investment grows significantly over five years thanks to compound interest, outperforming other local banks with lower rates.

Jane appreciates the low initial deposit requirement and the absence of monthly maintenance fees. Westfield Bank’s online platform lets her easily manage and track her CD, giving her peace of mind and confidence in her investment.

Jane increases her savings and achieves her financial goals by investing in an FDIC-insured CD, benefiting from minimal risk and reliability. Westfield Bank’s CD rates offer a secure and growth-oriented option for conservative investors.

FAQ of Westfield Bank CD Rates

What are the minimum deposit requirements?

for a Westfield Bank CD?

Westfield Bank requires a relatively low minimum deposit to open a CD,

making it accessible for many investors looking to start saving.

How does interest compounding

work for Westfield Bank CDs?

Interest on Westfield Bank CDs is typically compounded quarterly,

which helps increase the earnings on your initial deposit over the term of the CD.

Can I access my funds?

before the CD term ends?

Accessing funds before a CD term ends may incur early withdrawal penalties, impacting your earnings.

Are Westfield Bank CDs insured?

Westfield Bank CDs are FDIC-insured up to $250,000, ensuring a secure investment.

What happens at the end of the CD term?

At the end of the CD term, Westfield Bank offers an automatic renewal feature.

This means your CD will renew for the same term length at the current rate,

unless you instruct otherwise.

How do I open a CD with Westfield Bank?

You can open a CD online or at a branch with Westfield Bank. The process is straightforward and convenient.

Are there fees associated with

maintaining a CD at Westfield Bank?

Westfield Bank CDs have no monthly fees, maximizing your earnings.

How can I manage my CD account?

Westfield Bank’s online platform enables easy management of CD accounts, access to details, and secure transactions.

Do Westfield Bank CD rates vary?

CD rates at Westfield Bank fluctuate based on term length and market conditions.

It is advisable to check the current rates when considering opening a CD.

Can I add more funds to my CD after opening it?

Typically, once a CD is funded and opened, additional deposits cannot be added.

However, you can open new CDs if you wish to invest more funds.

Pros and Cons of Westfield Bank CD Rates

Pros

- Competitive Interest Rates: Westfield Bank provides competitive CD rates, helping investors maximize returns.

- FDIC Insurance: FDIC insurance protects investors’ deposits up to $250,000, ensuring financial security.

- Online Management: A user-friendly online platform simplifies CD account management for tech-savvy customers.

- Low Minimum Deposit: The low minimum deposit requirement allows investors from diverse financial backgrounds to begin saving easily.

- Flexibility in Term Lengths: Westfield Bank offers various term lengths to meet diverse financial needs and timelines.

Cons

- Early Withdrawal Penalties: Early access to funds may incur penalties, so it’s important to commit to the term length.

- Fixed Interest Rates: Fixed interest rates on CDs can be a drawback if market rates rise significantly during the term.

- Limited Additional Deposits: CDs usually don’t allow additional deposits after opening, limiting flexibility in managing extra savings.

- Automatic Renewals: CDs may automatically renew for the same term if not managed, possibly misaligning with changing financial goals.

- Accessibility: Westfield Bank, as a local bank, may have limited branch locations, which could be inconvenient for those outside their main service areas.

Blog

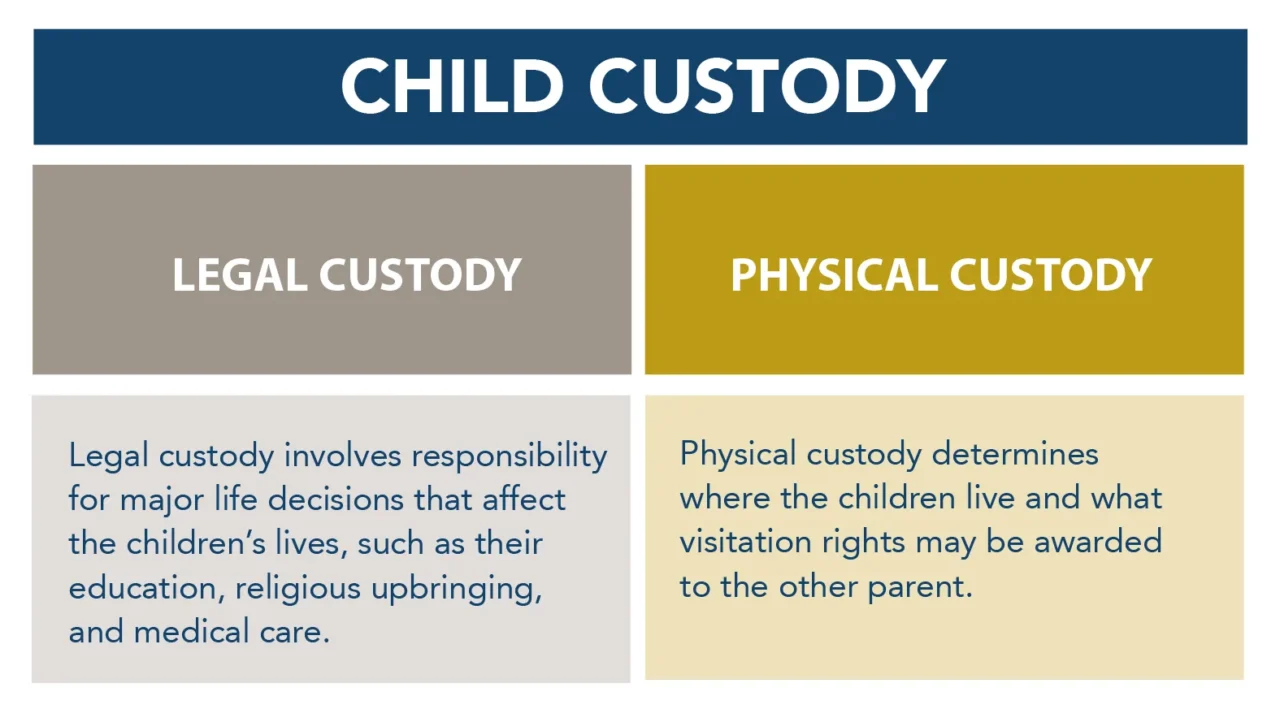

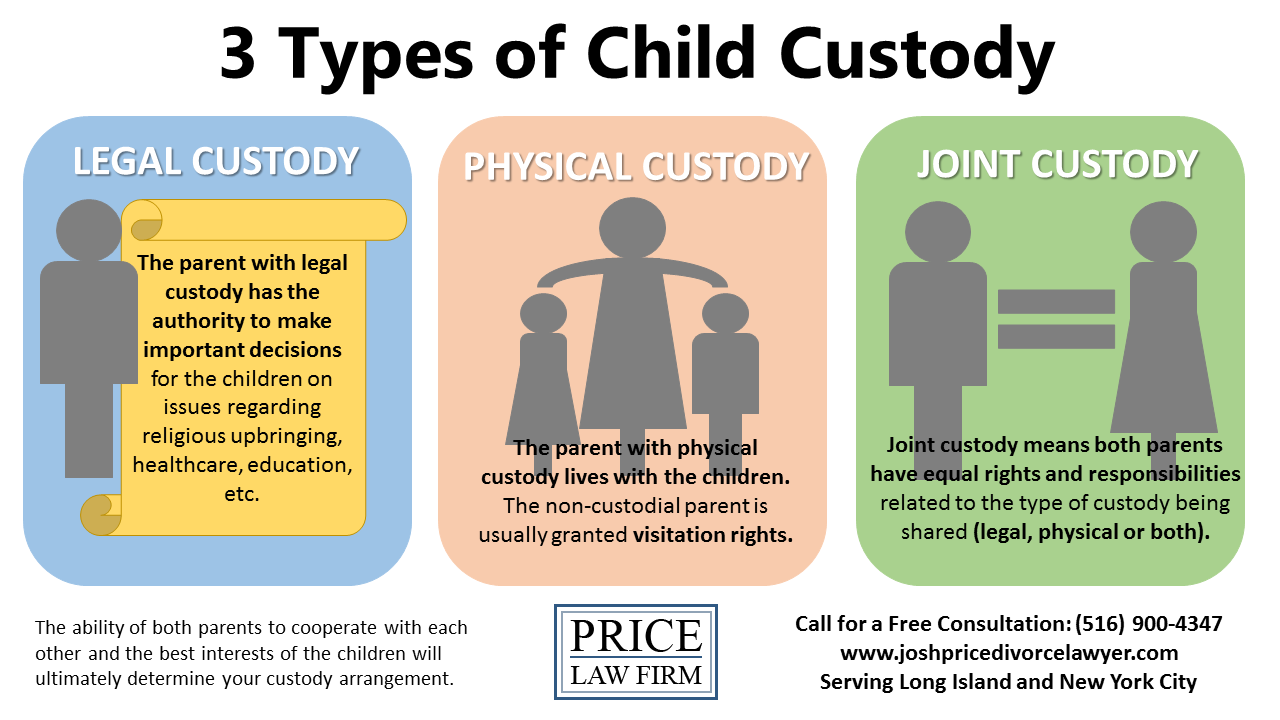

what is joint custody: Latest

Blog

Best Vacation Spots in the US:

A Guide for Citizens and Visitors

Best Vacation Spots in the US: The United States is a treasure trove of vacation destinations, offering an incredible variety of landscapes, cultures, and experiences. Whether you are a U.S. citizen exploring your own backyard or a traveler from abroad looking to immerse yourself in the American experience, there’s something for everyone. Here are some of the best vacation spots in the U.S. to consider for your next adventure.

1. New York City, New York

For a city that never sleeps, New York is a must-visit destination. Home to iconic landmarks like Times Square, the Statue of Liberty, and Central Park, the city offers a vibrant mix of culture, cuisine, and entertainment. Don’t miss the Broadway shows, world-class museums like the MET, and the bustling neighborhoods like SoHo and Williamsburg.

- Ideal For: Culture enthusiasts, foodies, and urban adventurers.

- Pro Tip: Visit during spring or fall to enjoy pleasant weather and fewer crowds.

2. Grand Canyon, Arizona

This natural wonder is awe-inspiring and a perfect destination for nature lovers. Hike along the South Rim, take a helicopter tour for breathtaking views, or raft down the Colorado River for an unforgettable adventure.

- Ideal For: Outdoor enthusiasts and families.

- Pro Tip: Sunrise and sunset offer the most stunning views.

3. Honolulu, Hawaii

Experience the tropical paradise of Hawaii’s capital city. From the famous Waikiki Beach to the historic Pearl Harbor sites, Honolulu is a blend of relaxation and cultural heritage.

- Ideal For: Beach lovers, surfers, and history buffs.

- Pro Tip: Explore nearby attractions like Diamond Head and Hanauma Bay for snorkeling.

4. Yellowstone National Park, Wyoming/Montana/Idaho

America’s first national park is a wonderland of geysers, hot springs, and diverse wildlife. Old Faithful and the Grand Prismatic Spring are must-sees, but the park also offers incredible hiking and camping opportunities.

- Ideal For: Nature lovers and adventure seekers.

- Pro Tip: Visit during late spring or early fall to avoid the summer crowds.

5. New Orleans, Louisiana

Known for its vibrant culture, jazz music, and Creole cuisine, New Orleans is a city like no other. The French Quarter, Bourbon Street, and Mardi Gras are just the beginning of what this lively city has to offer.

- Ideal For: Music lovers, food enthusiasts, and partygoers.

- Pro Tip: Visit in April for the New Orleans Jazz & Heritage Festival.

6. San Francisco, California

Famous for the Golden Gate Bridge, Alcatraz Island, and its eclectic neighborhoods, San Francisco offers a mix of natural beauty and urban charm. Explore Fisherman’s Wharf, ride the iconic cable cars, and take a day trip to wine country.

- Ideal For: Couples, families, and solo travelers.

- Pro Tip: Bring layers; the weather can change quickly.

7. Orlando, Florida

Orlando is a family-friendly destination that promises fun for all ages. Home to Walt Disney World, Universal Studios, and SeaWorld, it’s the ultimate spot for theme park enthusiasts.

- Ideal For: Families and thrill-seekers.

- Pro Tip: Plan your visit during weekdays to avoid long lines.

8. Las Vegas, Nevada

The entertainment capital of the world, Las Vegas is known for its vibrant nightlife, luxurious resorts, and world-class dining. Beyond the casinos, visitors can explore nearby attractions like the Hoover Dam and Red Rock Canyon.

- Ideal For: Nightlife enthusiasts and luxury travelers.

- Pro Tip: Check out the free shows like the Bellagio Fountains.

9. Charleston, South Carolina

This charming Southern city is known for its historic architecture, cobblestone streets, and warm hospitality. Visit the historic plantations, enjoy a carriage ride, and indulge in delicious Lowcountry cuisine.

- Ideal For: History buffs and couples.

- Pro Tip: Springtime offers beautiful blooms and pleasant weather.

10. Anchorage, Alaska

Best Vacation Spots in the US: For a taste of the wild, Anchorage is the gateway to Alaska’s rugged beauty. Experience glaciers, wildlife, and stunning mountain views. Don’t miss a cruise through the Kenai Fjords or a visit to Denali National Park.

- Ideal For: Adventure seekers and nature lovers.

- Pro Tip: Summer offers extended daylight hours to explore more.

The United States offers a rich tapestry of experiences, making it a top destination for travelers from all walks of life. Whether you’re looking for thrilling adventures, serene landscapes, or cultural immersion, the perfect vacation spot awaits you. Start planning your journey today!

Blog

The History of Google: Global Tech Giant

The History of Google: From a Research Project to a Global Giant

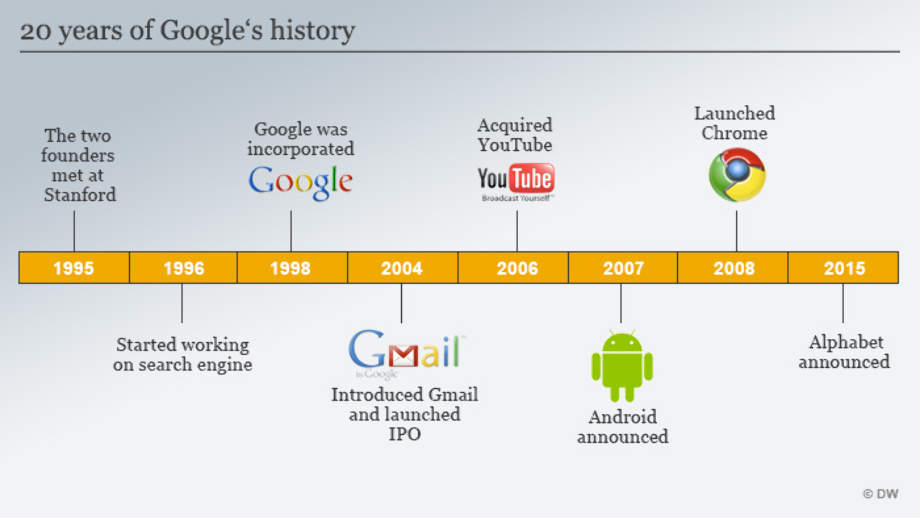

History of Google vision, and adaptability. Here’s a deep dive into the history of Google, its evolution, and its impact on the digital age.

Early Beginnings: The Birth of Google

Google was founded in September 1998 by Larry Page and Sergey Brin, both Stanford University graduate students. The pair met in 1995 when Larry was considering attending Stanford for his PhD and was introduced to Sergey, who was already a student. They began working together on a search engine project as part of Larry’s doctoral thesis.

Initially, the duo worked on a project called BackRub, which used a novel algorithm to rank web pages based on the number and quality of links pointing to them. This was a departure from the keyword-based search algorithms that were common at the time. They quickly realized the potential of this idea, which led to the creation of Google.

The name “Google” is a play on the word “googol,” which refers to the number 1 followed by 100 zeros, symbolizing the founders’ mission to organize an immense amount of information on the web.

The Early Growth: Launch and Expansion

Google’s first public release was in 1998, when it was still in beta and running on the Stanford University servers. The search engine quickly gained popularity due to its cleaner, faster interface and more relevant search results. By 1999, the company moved into a garage in Menlo Park, California, which is often considered Google’s official startup base.

In 2000, Google introduced its AdWords program, which allowed businesses to advertise on Google’s search results. This program became the backbone of Google’s revenue model, allowing the company to scale its operations rapidly.

Becoming a Household Name: IPO and Global Expansion

Google’s exponential growth continued in the early 2000s. The company expanded its range of services, including the introduction of Gmail in 2004, which revolutionized email with its 1GB storage and the use of an innovative conversation-based interface.

In 2004, Google went public, with its Initial Public Offering (IPO) raising nearly $2 billion. The stock price skyrocketed, and Google became a publicly traded company. This marked a pivotal moment in the company’s journey, solidifying its place in Silicon Valley’s elite tech companies.

After the IPO, Google continued to expand by acquiring other companies. In 2006, it acquired YouTube, further broadening its scope to video sharing. Over the next few years, Google acquired several other companies, including Android Inc. in 2005, which led to the development of the Android operating system—a key player in the mobile revolution.

The Google Era: Dominance and Innovation

In the following years, Google expanded into various markets, including cloud computing, hardware, and artificial intelligence. The company launched products like Google Maps, Google Drive, and Google Chrome, which have become central to everyday internet usage.

In 2015, Google reorganized itself under a new parent company called Alphabet Inc., with Google becoming its largest subsidiary. This restructuring allowed the company to focus on its core business while also exploring new ventures, including life sciences and autonomous vehicles through its various “Other Bets.”

Google also made strides in AI and machine learning with products like Google Assistant, Google Translate, and Google Cloud AI. The company’s algorithms are integral to billions of searches, and its AI-based technologies continue to drive innovation in numerous industries.

Controversies and Challenges

While Google’s success is undeniable, the company has also faced numerous controversies. Critics have raised concerns about issues such as privacy, monopoly, and censorship. Google has been involved in various antitrust investigations, particularly in the United States and Europe, over its dominance in the search engine market and its handling of user data.

The Future of Google

As of today, Google is an omnipresent force in the digital world, with products and services that touch nearly every aspect of modern life. The company’s search engine remains the most widely used globally, while innovations in AI, cloud computing, and self-driving technology position it to continue its growth for years to come.

Summary

From its humble beginnings as a university research project to a global technology leader, Google has dramatically transformed the way we interact with information. Its expansion into new markets and innovations in AI, search technology, and cloud services suggest that Google’s journey is far from over.

For further reading, you can refer to these sources:

-

SEO3 months ago

SEO3 months agoBest website platform for seo: top 5 popular websites, 1-book, 25 Top Free SEO Tools,

-

Blog5 months ago

Blog5 months agoMaria Taylor’s Husband: Jonathan Lee Hemphill’s Job, Family, and Kids Explained

-

FASHION2 months ago

FASHION2 months agoOld-Fashioned: Styles Across Generation

-

SEO3 months ago

SEO3 months agoGoogle Ranking Factors: top 50 factors

-

TECH2 months ago

TECH2 months agoRadiology Tech: Prices, Features, and Buy

-

Blog2 months ago

Blog2 months agoSigns of a Healthy Relationship:

-

YOGA2 months ago

YOGA2 months agoDental Care: Can Increase Your Life Expectancy

-

SEO3 months ago

SEO3 months agoDoes google business profile posting improve rankings: A Latest Guide to Google Visibility books