FINANCE

amazon small business lending: authentic solution with references to start amazon

A New Era for Entrepreneurs: Understanding Amazon Small Business Lending

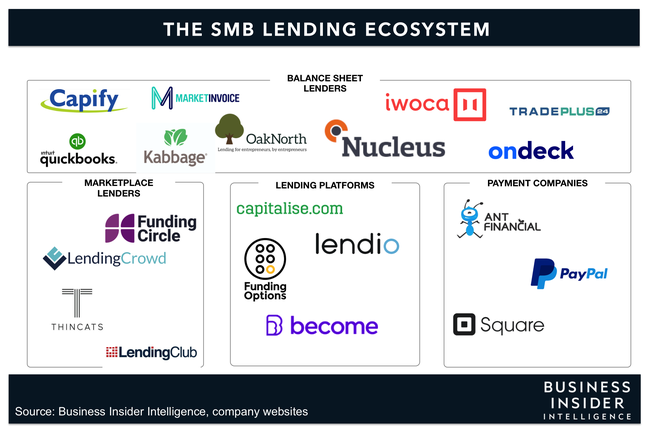

Amazon small business lending In today’s digital age, where e-commerce has become a vital part of the global economy, small businesses often find themselves in a challenging position. when it comes to accessing capital. Traditional banks are reluctant to lend to small online businesses due to perceived risks. Enter Amazon Small Business Lending, a program that empowers entrepreneurs by providing the financial boost needed to thrive in the digital marketplace.

The Rise of E-Commerce and the Need for Accessible Financing

With the rapid expansion of e-commerce, small businesses have unprecedented opportunities to reach customers worldwide. However, this growth also brings unique challenges, particularly in terms of financing. Many small business owners struggle to secure loans from traditional banks due to stringent requirements and lengthy approval processes. Recognizing this gap, Amazon launched its Small Business Lending program to address the specific needs of e-commerce entrepreneurs.

What is Amazon Small Business Lending?

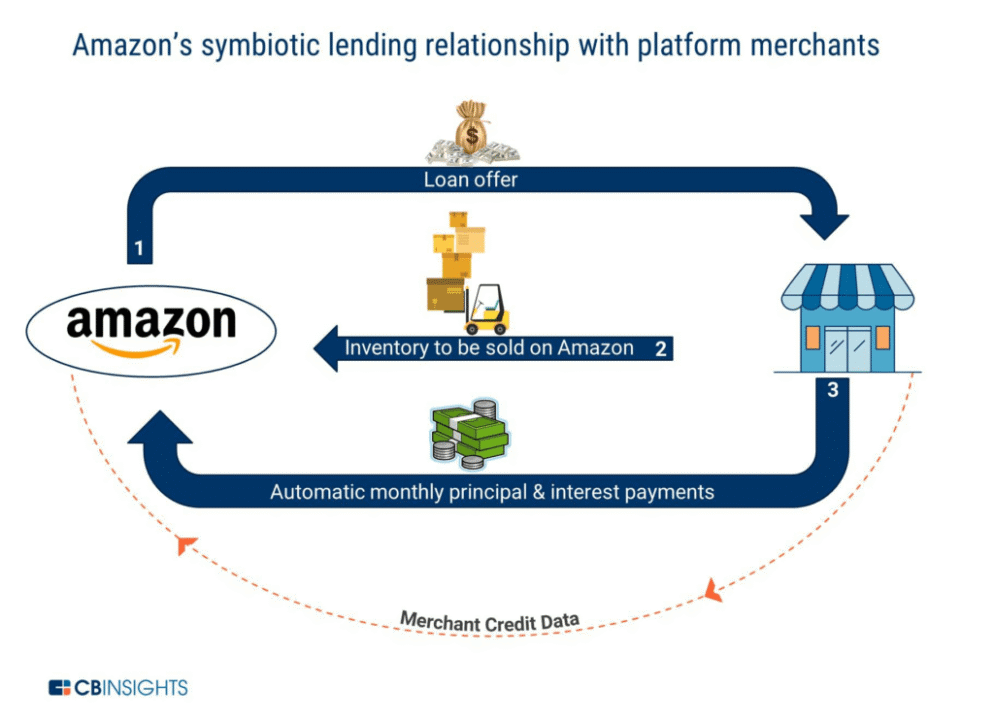

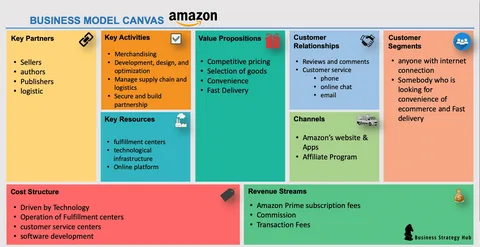

Amazon Small Business Lending is a service that provides eligible sellers on Amazon’s platform with access to loans to enhance their business operations. This program is particularly beneficial for small and medium-sized enterprises (SMEs) that may not qualify for conventional bank loans. By offering a streamlined application process and competitive interest rates, Amazon aims to support business owners in scaling their operations, managing cash flow, and investing in inventory or marketing.

How Does It Work?

The application process for Amazon Small Business Lending is simple and efficient. Eligible sellers receive an invitation from Amazon, allowing them to apply for a loan directly through their seller account. The loans are typically short-term, with terms ranging from three to twelve months, and amounts vary based on the seller’s sales performance and business needs.

One of the key advantages of Amazon Small Business Lending is the speed of the approval process. Unlike traditional loans that may take weeks or even months to secure, Amazon’s program often provides funding within five business days of approval. This quick turnaround time is crucial for businesses looking to seize immediate opportunities or address urgent financial needs.

Benefits for Small Business Owners

- Access to Capital: Amazon Small Business Lending offers entrepreneurs an alternative to traditional funding. This capital helps businesses invest in growth, like expanding product lines or boosting marketing.

- Competitive Interest Rates: The lending program offers competitive rates, often better than traditional lenders, allowing business owners to borrow at lower costs and improve profitability.

- Tailored Loan Amounts: Loan amounts are tailored to the seller’s performance and needs, ensuring businesses get the right funding without excessive debt.

- Flexible Repayment Terms: The program offers flexible repayment terms for sellers, aligning with their cash flow to enhance financial management and reduce default risk.

- No Hidden Fees:Amazon’s lending program emphasizes transparency, offering clear financial terms with no hidden fees for business owners.

How to Make the Most of Amazon Small Business Lending

Small business owners should strategically assess Amazon Small Business Lending. Key tips can help maximize the program’s benefits.

- Evaluate Your Needs: Evaluate your business needs and objectives before applying for a loan, to ensure funds effectively drive growth and improve operations.

- Monitor Sales Performance: Focus on optimizing your sales strategy to boost consistent growth, as loan eligibility depends on sales performance, enhancing your chances for higher loan offers.

- Plan for Repayment: Create a repayment plan matching your cash flow, avoid overextending finances, and ensure comfortable repayment.

- Leverage Funds Wisely:Strategically use loan funds for high-return investments by expanding products, improving your website, or enhancing customer service to drive long-term growth.

Requirements for Amazon Small Business Lending

To be eligible for Amazon Small Business Lending, sellers must meet certain criteria that signify their stability and potential for growth. Firstly, a seller needs to have an established track record of sales on the Amazon platform since the lending program evaluates the seller’s sales performance and account health. Additionally, having a strong account history further supports eligibility. Consequently, sellers who meet these criteria are more likely to benefit from the lending program.

Active participation in Amazon’s marketplace as a seller is crucial, since Amazon uses seller performance metrics to gauge the viability of offering a loan. Additionally, sellers should ensure their account remains in good standing, with no unresolved policy violations. Consequently, this not only reflects the business’s credibility, but also impacts the loan amount and terms offered.

Although Amazon does not require a conventional credit check, they nevertheless consider various data-driven criteria based on the seller’s activity on their platform. Consequently, the entire process aims to identify sellers who are positioned to benefit from added capital, thereby fostering a mutually beneficial relationship.

Loan Summary Amount to Start Amazon Small Business Lending

The amount available for loans under the Amazon Small Business Lending program varies depending on the seller’s sales performance and business history on the platform. Consequently, loan amounts can range from $1,000 to $750,000. This flexibility ensures that businesses of various sizes can access funding tailored to meet their individual needs and growth strategies. Furthermore, this range accommodates both small and large businesses, thereby supporting diverse growth strategies.

Amazon assesses each seller’s eligibility based on sales metrics, customer feedback, and other critical criteria to determine creditworthiness. Consequently, sellers are encouraged to maintain robust sales records and a positive reputation to optimize their loan offerings. Furthermore, understanding these factors can help sellers effectively plan their financial strategies and, thus, leverage additional capital for business expansion.

Shop Size Requirements for Amazon Small Business Lending

Amazon Small Business Lending requires sellers to meet sales performance criteria and specific shop size requirements. These requirements ensure the business has the infrastructure and capacity to manage growth from additional capital. Shop size is evaluated by the number of active listings and average monthly sales.

Sellers with at least $10,000 in monthly sales are seen as eligible, reflecting business maturity and market engagement. A diverse inventory with various products enhances eligibility by showing adaptability to market demands and driving consistent sales. Meeting shop size requirements enables businesses to access loans and position them for growth within Amazon’s marketplace.

Required Documents for Amazon Small Business Lending

- Business Identification: A business registration certificate or similar document is needed to verify legal ownership.

- Bank Statements: Recent bank statements are needed to evaluate the business’s financial health and cash flow.

- Sales Reports: Sales reports from Amazon seller accounts are crucial for verifying performance and stability, key factors in loan eligibility.

- Tax Identification Number (TIN): The TIN or equivalent tax ID ensures business tax compliance.

- Personal Identification: A government-issued photo ID, like a driver’s license or passport, may be needed for verification.

Amazon Small Business Lending Dealing Desk

The Amazon Small Business Lending Dealing Desk plays a crucial role in facilitating the interaction between Amazon and its cellars during the loan process. It acts as a central hub where all queries, negotiations, and communications regarding loans are managed.

Sellers can contact the dealing desk to discuss specific loan terms, clarify repayment schedules, and address any concerns related to their loan applications. This proactive engagement helps sellers optimize borrowing conditions to suit their financial strategies.

The dealing desk also provides valuable insights into the loan process, ensuring clear and transparent communication. Sellers are encouraged to maintain ongoing interaction with the dealing desk to maximize the benefits of their loan. They are encouraged to leverage Amazon’s expertise to navigate potential challenges and make informed financial decisions.

Contact Information for Amazon Small Business Lending Inquiries

- General Inquiries: lending@amazon.com

- Application Support: lending-support@amazon.com

- Payment and Repayment Questions: lending-payments@amazon.com

Global Contact Information for Amazon Small Business Lending Dealing Desk

Amazon Small Business Lending provides worldwide support through a dealing desk, allowing sellers to access assistance globally. Sellers can contact the dealing desk based on their region for inquiries.

- North America: na-lending-desk@amazon.com

- Europe: eu-lending-desk@amazon.com

- Asia-Pacific: apac-lending-desk@amazon.com

- Latin America: latam-lending-desk@amazon.com

Recommended Book for Amazon Small Business Lending

For those wanting to understand small business financing better and seize opportunities from Amazon Small Business Lending. “The Lean Startup” by Eric Ries is a highly recommended book. It explains how entrepreneurs use continuous innovation to create successful businesses.

The book offers insights into creating resilient businesses and tackling financial challenges using innovative and agile approaches. Rise offers guidance on handling uncertainty and making smart funding and investment decisions for sustainable growth.

His principles optimize borrowing strategies and effectively use lending platforms. This book is essential for entrepreneurs looking to succeed in e-commerce at any stage.

Pros and Cons of Amazon Small Business Lending

Amazon Small Business Lending offers several benefits for sellers, but sellers should also consider some drawbacks.

Pros

- Fast and Convenient Access: Amazon offers a quick and efficient application process for sellers to access funds swiftly, meeting immediate business needs.

- Competitive Rates: The lending program provides competitive interest rates, appealing to cost-conscious entrepreneurs.

- Tailored Solutions: Loans are tailored to a seller’s performance and financial history on Amazon to ensure suitable funding.

- Direct Integration: The program integrates with Amazon, allowing sellers to manage loans alongside their business operations, eliminating the need for multiple financial platforms.

- Trusted Platform: strong infrastructure ensures reliability and confidence, giving sellers peace of mind when borrowing.

Cons

- Limited to Amazon Sellers: The program is only available to Amazon seller account holders, excluding businesses outside the platform.

- Loan Amount Limitations: the seller’s performance history might limit loan amounts, affecting access to higher funding for businesses needing substantial capital.

- Repayment Terms: Automatic loan repayments from sales revenue may affect cash flow for sellers with inconsistent sales.

- Dependency on Amazon: Sellers tied to Amazon’s ecosystem may become financially dependent on the platform, limiting diversification opportunities.

- Rigid Eligibility Criteria: criteria for sellers may exclude new or smaller businesses without an established sales record.

FAQs for

What is Amazon Small Business Lending?

Small Business Lending provides eligible sellers with competitive loans. Therefore, they can expand their business, manage inventory, and efficiently cover expenses.

How do I qualify for an Amazon Small Business Loan?

To qualify for an Small Business Loan, maintain an established seller account with consistent sales. Meet Amazon’s eligibility by reviewing your business metrics.the customer feedback, and account health.

How much can I borrow through Amazon Lending?

Lending adjusts loan amounts based on each seller’s circumstances and performance. Amazon evaluates your business’s financial health. I determine your maximum loan eligibility, resulting in varied loan amounts.

What are the repayment terms for Amazon Lending?

Lending tailors repayment terms to the loan agreement, with payments automatically deducted from Amazon sales. Ensure seamless repayment, but be aware of how deductions impact cash flow, particularly during slow sales periods.

How long does it take to receive funds after approval?

Approved loan applications typically result in funds being deposited in your bank account within a few business days. Amazon strives for quick deposits, but the timeline varies based on your bank’s processing times.

Final Verdict on Starting Amazon Small Business Lending

Entering the Small Business Lending offers sellers opportunities to enhance their business ventures. The program’s easy access, competitive rates, and direct Amazon integration make it a top choice for eligible sellers.

It offers fast funding and customized financial support, helping manage business growth and expenses based on seller performance. However, borrowers must weigh these benefits against constraints like being limited to Amazon sellers and potential loan caps.

Careful financial planning is needed to manage cash The movement since automatic repayment deductions occur. Consequently, organizing finances becomes crucial. Additionally, planning helps prevent potential financial shortfalls. The decision to use Amazon Small Business Lending. yourself should be based on evaluating your business needs and growth objectives. You should consider this. your reliance on Amazon’s ecosystem. For sellers linked to Amazon, this program is vital for growth and staying competitive.

FINANCE

Crypto-Legacy.App Software:Complete Guide

FINANCE

Should I Buy Bitcoin: in 2025? Complete Guide

A Historical Overview and Future Predictions

Should I Buy Bitcoin (BTC), the world’s first decentralized cryptocurrency, continues to attract investors worldwide as it evolves. Since its inception in 2009, Bitcoin has experienced remarkable highs and lows, leaving many to question its future trajectory. In this article, we explore Bitcoin’s historical performance, analyze its recent trends, and provide insights into whether investing in Bitcoin in 2025 is a wise decision.

A Brief History of Bitcoin

The Early Years (2009-2012):

Bitcoin was introduced in 2009 by an anonymous figure or group known as Satoshi Nakamoto. Initially valued at fractions of a cent, Bitcoin gained traction in 2010 when it was first used for a real-world transaction—10,000 BTC for two pizzas. By 2012, Bitcoin reached $13, as awareness and adoption began to grow.

First Boom and Bust (2013-2015):

Bitcoin experienced its first major price surge in 2013, skyrocketing to over $1,000. However, regulatory concerns and the collapse of the Mt. Gox exchange in 2014 caused the price to plummet below $300, highlighting the volatility of this emerging asset.

The 2017 Bull Run:

Bitcoin saw a meteoric rise in 2017, fueled by retail investor interest and growing adoption. Its price peaked near $20,000 in December 2017. However, a sharp correction followed in 2018, with Bitcoin falling to around $3,000 by the end of the year.

The 2020-2021 Explosion:

The COVID-19 pandemic in 2020 marked a turning point for Bitcoin, as institutional investors began to view it as a hedge against inflation. Bitcoin hit an all-time high of nearly $69,000 in November 2021, driven by mainstream adoption and significant investments from companies like Tesla and MicroStrategy.

The 2022 Crypto Winter:

Following its 2021 peak, Bitcoin faced significant challenges in 2022, including rising interest rates, economic uncertainty, and major industry scandals like the collapse of the FTX exchange. Bitcoin’s price fell below $16,000 at its lowest point.

Bitcoin in 2023-2024: Recovery and Consolidation

The crypto market began to stabilize in 2023 as macroeconomic conditions improved. Regulatory clarity in several regions, along with increasing institutional interest, pushed Bitcoin’s price above $35,000 by late 2023. Adoption grew further, with companies like BlackRock filing for Bitcoin spot ETFs, signaling mainstream acceptance.

By 2024, Bitcoin benefited from the hype surrounding its fourth halving event. The halving reduced the block reward from 6.25 BTC to 3.125 BTC, effectively lowering the rate of new Bitcoin issuance. Historically, halving events have preceded significant bull runs, as reduced supply creates scarcity in the market.

Predictions for Bitcoin in 2025

Factors Supporting Growth in 2025:

- Institutional Adoption:

Institutional participation in the Bitcoin market is expected to grow. Bitcoin ETFs and broader acceptance among hedge funds and asset managers could provide a steady influx of capital. - Inflation Hedge:

Amid global economic uncertainties, Bitcoin is increasingly viewed as “digital gold.” Its limited supply of 21 million coins ensures scarcity, making it a potential hedge against inflation. - Global Acceptance:

More countries may follow El Salvador’s example in adopting Bitcoin as legal tender. Blockchain technology’s increasing use in remittances and financial systems could drive demand further. - Technological Advancements:

Bitcoin’s Layer 2 solutions, like the Lightning Network, could improve transaction efficiency and scalability, making Bitcoin more appealing for everyday use.

Potential Risks in 2025:

- Regulatory Challenges:

Governments worldwide continue to grapple with regulating cryptocurrencies. Harsh regulatory actions in major economies could dampen Bitcoin’s growth. - Competition from Altcoins and CBDCs:

Alternative cryptocurrencies and Central Bank Digital Currencies (CBDCs) could compete with Bitcoin, particularly in the realm of payments and smart contracts. - Volatility:

Bitcoin’s price volatility remains a concern. While it presents opportunities for profit, it also increases risks for new investors.

Predicted Price Range for 2025:

Experts offer varied predictions for Bitcoin’s price in 2025, ranging from $100,000 to $250,000, assuming continued adoption and positive macroeconomic trends. However, some caution that a significant market downturn could see Bitcoin trading closer to $50,000.

Should You Buy Bitcoin in 2025?

Whether Bitcoin is a good investment in 2025 depends on your financial goals, risk tolerance, and investment strategy. Here are key points to consider:

- Long-Term Investment:

Bitcoin’s limited supply and growing institutional adoption make it an attractive long-term asset. Investors with a high-risk tolerance and a belief in Bitcoin’s future utility may find it worthwhile. - Diversification:

Bitcoin can serve as a diversification tool in a broader investment portfolio, balancing traditional assets like stocks and bonds. - Risk Management:

Due to its volatility, experts recommend allocating no more than 5-10% of your portfolio to Bitcoin.

Summary

Bitcoin’s journey from an obscure digital asset to a trillion-dollar market leader highlights its transformative potential. While the past demonstrates Bitcoin’s resilience, future success hinges on adoption, regulatory clarity, and technological advancements.

Investing in Bitcoin in 2025 could yield substantial rewards, but it comes with inherent risks. As with any investment, conducting thorough research and consulting with financial advisors is essential.

References

- Nakamoto, S. (2009). Bitcoin: A Peer-to-Peer Electronic Cash System.

- “Bitcoin Price History: A Timeline of Key Events.” Investopedia.

- “What to Expect from Bitcoin After the 2024 Halving.” CoinDesk.

- “Institutional Adoption of Bitcoin: 2025 Predictions.” Bloomberg.

- “The Role of Bitcoin in Diversified Portfolios.” Forbes.

Historical Performance: The Rollercoaster Ride

Bitcoin’s journey has been marked by incredible volatility. After its inception in 2009, Bitcoin’s value surged from less than $1 to nearly $20,000 in 2017. Following a severe correction, it rebounded, peaking at nearly $69,000 in late 2021 during the bull market. However, the 2022 bear market saw it dip below $20,000. By 2024, Bitcoin recovered dramatically, trading around $90,000 and nearing the $100,000 milestone【13】【14】.

Current Trends in 2024

- Institutional Adoption: The approval of spot Bitcoin ETFs in January 2024 significantly boosted institutional interest, with inflows exceeding $6 billion. Major players like BlackRock and Fidelity now offer Bitcoin-related financial products, contributing to mainstream adoption【13】【14】.

- Halving Impact: The April 2024 Bitcoin halving, which reduced mining rewards, historically triggers price surges by limiting supply. Analysts expect this event to be a key driver for 2025 price growth【14】【15】.

- Regulatory Environment: A more crypto-friendly U.S. administration under President-elect Donald Trump has bolstered optimism. Policies supporting Bitcoin adoption as a reserve asset could further solidify its role in global finance【13】【14】.

Expert Predictions for 2025

Predictions for Bitcoin’s price in 2025 vary widely:

- Bullish Projections: Analysts like Michael Saylor and Tim Draper foresee Bitcoin hitting $250,000 or more, citing increasing adoption and its scarcity-driven value proposition【13】【15】.

- Conservative Estimates: Institutions like Standard Chartered and Pantera Capital predict prices in the range of $115,000 to $200,000【14】【15】.

- Optimistic Scenarios: Some experts, including PlanB and Arthur Hayes, envision Bitcoin reaching $1 million under favorable economic and regulatory conditions【14】【15】.

Factors Influencing Bitcoin’s Future

- Macroeconomic Conditions: Rising inflation and concerns over fiat currency devaluation make Bitcoin an attractive hedge.

- Spot ETF Growth: Continued adoption of Bitcoin ETFs will likely attract more institutional investors.

- Regulatory Clarity: Supportive policies could pave the way for broader adoption, while restrictive ones may limit growth.

- Market Cycles: Bitcoin’s cyclical nature often leads to price spikes post-halving events【14】【15】.

Risks to Consider

- Volatility: Bitcoin remains highly volatile, and substantial price swings are expected.

- Regulatory Challenges: Unexpected restrictions in major markets could adversely impact Bitcoin’s growth.

- Market Saturation: Overreliance on institutional demand could lead to slower growth if demand plateaus【14】【15】.

Should You Buy Bitcoin?

Bitcoin’s strong fundamentals and growing institutional backing make it a compelling investment for 2025. However, its volatility and uncertain regulatory environment demand careful consideration. Diversifying your portfolio and consulting with a financial advisor are crucial before making a decision.

For more insights, explore detailed forecasts on platforms like CoinMarketCap and KuCoin.

Blog

fintechzoom.com crypto market cap: latest

Exploring the Crypto Market Cap Insights on FintechZoom.com

fintechzoom.com crypto market cap The cryptocurrency market has emerged as a key player in modern finance, with its market cap showcasing trends that attract both novice and seasoned investors. FintechZoom provides a detailed and analytical perspective on this rapidly evolving industry, focusing on market capitalization, regulatory challenges, and investment strategies.

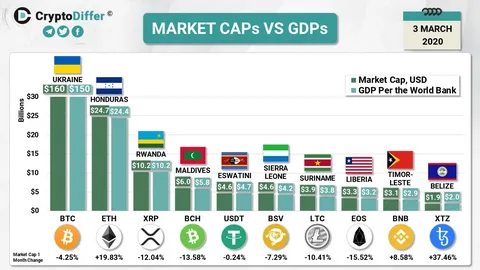

The Current State of the Crypto Market

As of 2024, the global cryptocurrency market cap has exceeded $1.8 trillion, reflecting a compound annual growth rate (CAGR) of 11.1% since 2018. This surge is attributed to increasing institutional adoption, the rise of decentralized finance (DeFi), and growing interest in blockchain applications【104†source】【105†source】.

Key Features of FintechZoom’s Crypto Market Analysis

- Price and Market Analysis:

FintechZoom tracks price movements of leading cryptocurrencies like Bitcoin, Ethereum, and Cardano. Analysts delve into trends, enabling informed decision-making for traders and investors【104†source】【105†source】. - Blockchain Innovations:

Reports highlight advancements in blockchain technology, emphasizing its applications beyond cryptocurrency in sectors like healthcare, supply chain, and finance. - Regulatory Updates:

The site details global regulatory shifts affecting cryptocurrencies, such as the United States Securities and Exchange Commission (SEC)’s stance on token classifications and international tax reforms impacting crypto trading【105†source】. - Expert Insights:

Regular expert interviews provide nuanced views on market dynamics and strategic investment【104†source】.

Market Players and Trends

Top 10 Most Important Points About the Crypto Market Cap

- Definition and Significance

Crypto market capitalization is the total value of all cryptocurrencies in circulation. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. This metric provides insight into the overall size and health of the crypto market【104†source】【105†source】. - Market Leaders by Market Cap

Bitcoin (BTC) and Ethereum (ETH) dominate the market, accounting for over 60% of the total crypto market capitalization as of 2024. Their dominance reflects their widespread adoption and use cases【104†source】. - Volatility and Trends

Cryptocurrencies are highly volatile, with market caps fluctuating rapidly due to changes in investor sentiment, regulatory news, and macroeconomic factors. This volatility offers high-risk, high-reward opportunities for investors【105†source】. - Impact of Institutional Investment

Institutional investors are driving market growth, with Bitcoin ETFs and corporate investments into blockchain technology bolstering market capitalization. The approval of spot Bitcoin ETFs in early 2024 exemplifies this trend【105†source】. - Role of Decentralized Finance (DeFi)

DeFi applications, which allow users to borrow, lend, and trade without intermediaries, have significantly contributed to the market cap of cryptocurrencies like Ethereum and Solana【104†source】. - Regulatory Challenges and Adaptations

Regulatory clarity remains a pivotal factor influencing market cap. Countries with clear crypto regulations, such as Japan and Switzerland, have seen higher adoption rates and more stable market growth【105†source】. -

Correlation with Traditional Markets

Cryptocurrencies show lower correlation with traditional financial markets, making them an attractive asset class for diversification. This independence, however, also contributes to their volatility【105†source】. - Emergence of Stablecoins

Stablecoins like Tether (USDT) and USD Coin (USDC) are key players in the crypto market. Their market caps are growing due to their use in trading and as a store of value amid market volatility【105†source】. - Global Adoption Trends

Emerging economies are leading in crypto adoption, using digital currencies as alternatives to unstable fiat currencies. Countries like Nigeria and El Salvador are notable examples【104†source】. - Technological Advancements

Innovations in blockchain scalability, such as Ethereum’s transition to a proof-of-stake consensus mechanism, have positively influenced the market cap by attracting environmentally conscious investors and reducing energy consumption【105†source】.

References

- Crypto FintechZoom: Market Overview

- CoinMarketCap: Comprehensive Market Data

- Investopedia: Understanding Cryptocurrency Market Cap

These points highlight the dynamic nature of the cryptocurrency market and the factors influencing its market cap. For detailed insights, refer to resources like FintechZoom and CoinMarketCap.

| Category | Top Players | Description |

|---|---|---|

| Cryptocurrencies | Bitcoin, Ethereum, Solana | Leading assets by market capitalization. |

| Exchanges | Coinbase, Binance, Kraken | Platforms for buying, selling, and trading crypto. |

| Blockchain Firms | ConsenSys, Hyperledger | Innovators in blockchain infrastructure development. |

Challenges and Future Outlook

- Volatility: Cryptocurrency markets are known for extreme price swings, presenting both opportunities and risks for investors.

- Regulation: Inconsistent global regulatory frameworks create uncertainty for users and businesses【105†source】.

- Adoption: Emerging markets are experiencing rapid adoption, driven by decentralized applications and accessibility.

Latest Research and Expert Verdicts

Recent research emphasizes the impact of regulatory clarity on market stability. Analysts forecast further institutional adoption if regulatory challenges are addressed effectively. Financial experts suggest that diversification within crypto portfolios and cautious investment in tokenized assets can mitigate risks while capitalizing on growth opportunities【105†source】.

Detailed FAQs About the Crypto Market Cap

1. What is crypto market cap, and why is it important?

The cryptocurrency market cap is the total value of a cryptocurrency or the entire market. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. It provides a snapshot of the market’s size and health, helping investors compare different cryptocurrencies and track growth over time【104†source】【105†source】.

2. What is the difference between circulating supply and total supply?

- Circulating Supply: The number of coins or tokens actively available in the market.

- Total Supply: The total amount of coins or tokens that exist, including those not yet released or locked.

The market cap is typically calculated using the circulating supply, as it reflects the available tradable value of a cryptocurrency【105†source】.

3. How does the crypto market cap compare to traditional markets?

The global crypto market cap is smaller than traditional markets like stocks or bonds. However, its growth rate is significantly higher due to innovations in blockchain technology and increasing adoption by both retail and institutional investors【105†source】【104†source】.

4. Which cryptocurrencies have the highest market caps?

As of 2024, Bitcoin (BTC) and Ethereum (ETH) lead the market, followed by stablecoins like Tether (USDT) and altcoins like Binance Coin (BNB) and Solana (SOL)【105†source】.

5. What factors influence the market cap of a cryptocurrency?

Several factors impact market capitalization, including:

- Price fluctuations.

- Adoption rates and utility of the cryptocurrency.

- Supply dynamics, including token burns or minting.

- Investor sentiment and market trends【105†source】【104†source】.

6. What is the impact of regulatory changes on market cap?

Regulatory clarity can boost market confidence, encouraging investment and driving growth in market cap. Conversely, restrictive regulations or uncertainty can lead to market cap declines as investors retreat【105†source】.

7. How is market cap different from fully diluted valuation (FDV)?

- Market Cap: Uses the circulating supply to calculate the value.

- FDV: Considers the total supply (including locked or unreleased tokens) to estimate the potential maximum value of a cryptocurrency【105†source】.

8. Why are stablecoins significant in the market cap rankings?

Stablecoins like USDT and USDC provide liquidity to the market and are widely used for trading and as a hedge against volatility. Their steady values contribute significantly to the market’s stability【105†source】【104†source】.

9. Can market cap predict the future price of a cryptocurrency?

Market cap provides a measure of size and popularity but does not guarantee future price performance. Other factors like utility, technological advancements, and market sentiment play critical roles【104†source】.

10. How can investors use market cap data effectively?

Investors use market cap data to:

- Compare the relative size of cryptocurrencies.

- Identify growth opportunities by analyzing smaller-cap coins with potential.

- Assess the risk level—larger caps are typically less volatile but have slower growth【105†source】.

For further reading and in-depth analysis, consult resources like FintechZoom, CoinMarketCap, and Investopedia.

This overview demonstrates FintechZoom’s critical role in providing comprehensive coverage of the cryptocurrency market. For additional information, you can explore FintechZoom’s official website and related resources【105†source】.

-

SEO3 months ago

SEO3 months agoBest website platform for seo: top 5 popular websites, 1-book, 25 Top Free SEO Tools,

-

Blog5 months ago

Blog5 months agoMaria Taylor’s Husband: Jonathan Lee Hemphill’s Job, Family, and Kids Explained

-

FASHION2 months ago

FASHION2 months agoOld-Fashioned: Styles Across Generation

-

TECH2 months ago

TECH2 months agoRadiology Tech: Prices, Features, and Buy

-

SEO3 months ago

SEO3 months agoGoogle Ranking Factors: top 50 factors

-

Blog2 months ago

Blog2 months agoSigns of a Healthy Relationship:

-

YOGA2 months ago

YOGA2 months agoDental Care: Can Increase Your Life Expectancy

-

SEO3 months ago

SEO3 months agoDoes google business profile posting improve rankings: A Latest Guide to Google Visibility books