FINANCE

zearn referral code crypto: video, audio, 5 books latest recommendations

Zearn Referral Code Crypto

zearn referral code crypto Cryptocurrency is revolutionizing various sectors. This includes educational platforms like Zearn. Zearn offers math learning resources. It recently introduced a referral code system. This system encourages users to share Zearn with others for rewards. Let’s explore how Zearn’s referral code system intersects with cryptocurrency.

What is Zearn?

Zearn is an online platform. It provides engaging math resources for students. It offers interactive lessons. Personalized feedback enhances learning. Teachers widely use Zearn. It supplements traditional classroom teaching methods.

Introduction to Zearn’s Referral Code System

Zearn recently launched a referral code system. It aims to expand its user base. Users can share their unique referral codes with friends and family. New users sign up using these codes. Both parties receive rewards.

The Role of Cryptocurrency in Zearn’s Referral System

Cryptocurrencies can enhance Zearn’s referral system with digital rewards. They offer fast, secure transactions without intermediaries. These can be used as rewards for successful referrals on platforms like Zearn.

Benefits of Using Cryptocurrencies in Referral Systems

Cryptocurrencies offer transparency and security for referral rewards. They enable quick transactions without third-party involvement. Users can track and verify transactions using blockchain technology.

How to Use Zearn’s Referral Code

To use Zearn’s referral code, users must create an account. They can find their unique referral code in their account settings. Sharing this code with potential new users can lead to rewards.

Top 5 Points for Users on Zearn Referral Code Crypto

- Ease of Use:

- Zearn’s referral code system is easy to use. Sharing and using codes is straightforward. Users distribute their unique codes to friends or family. This is for those interested in joining the platform.

- Reward System:

- Users benefit from a tangible reward structure. Each successful referral grants a cryptocurrency reward. Both the referrer and the new user receive this reward. This enhances the incentive for participation.

- Secure Transactions:

- The integration of cryptocurrency ensures secure and swift reward transfers. Intermediaries are not needed. This reduces transaction costs and potential delays.

- Track Your Success:

- Blockchain technology offers transparency. Users can track their referrals and rewards. This creates a verifiable record of each referral event. It ensures clarity and trust in the system.

- Maximize Earnings:

- Active users can maximize their benefits by sharing codes widely. Successful referrals to Zearn increase potential cryptocurrency rewards. This is an attractive opportunity for tech-savvy math enthusiasts.

Zearn Referral Code Crypto: Latest Research and Updates

Recent analyses show new trends in referral code systems with cryptocurrency integration. Research indicates platforms like Zearn boost user engagement with digital rewards. Studies suggest blockchain’s transparency and efficiency enhance trust. This can lead to greater adoption of referral programs.

Latest Updates

- Enhanced Security Protocols: Zearn has adopted advanced encryption measures to safeguard user data and cryptocurrency transactions. This update ensures that user information and digital wallets remain protected from potential cybersecurity threats.

- Partnerships with Cryptocurrency Platforms: Zearn is exploring partnerships with popular cryptocurrency exchanges to streamline the conversion of referral rewards into local currencies. This move aims to increase accessibility for users unfamiliar with crypto transactions.

- User Feedback Integration: Zearn actively collects and considers user feedback to refine the referral code system. Recent updates focus on improving the user interface and simplifying the process of tracking referral progress and rewards.

- Expanded Cryptocurrency Options: In response to user demand, Zearn is expanding the range of cryptocurrencies available for referral rewards. This allows users to choose their preferred digital currency, offering personalized reward options.

- Educational Resources: To aid users new to cryptocurrencies, Zearn is developing educational materials that explain digital currencies’ basics and how to navigate the referral system effectively. These resources aim to bridge the knowledge gap and empower all users to participate confidently.

Zearn remains at the forefront of these developments. It continues to enhance the user experience. The referral code crypto system is seamless. It is a rewarding aspect of its educational platform.

Renowned Web Resources on Zearn Referral Code Crypto Updates

Exploring renowned web resources offers valuable insights into the Zearn referral code crypto system. Users can learn about its latest developments. Websites like CoinDesk and CoinTelegraph feature articles on educational platforms using cryptocurrency technologies. They provide updates on trends and innovations. Key benefits include improved security and increased accessibility in referral systems. EdSurge and EdTech Magazine offer educational perspectives. They focus on how platforms like Zearn adapt digital rewards to enhance learning experiences. Consulting these resources keeps users informed about cutting-edge strategies. They also highlight potential implications for educational technology.

Recommended Books on Zearn Referral Code Crypto

For users interested in understanding cryptocurrency and its applications in referral systems like Zearn’s, several insightful books provide valuable knowledge and guidance. Use the Zearn referral code CRYPTO for special offers.

- “Mastering Bitcoin” by Andreas M. Antonopoulos – This book is a comprehensive guide to understanding Bitcoin, the digital currency that revolutionized the concept of online transactions. It provides a foundational understanding of cryptocurrencies, making it a great starting point for those new to the technology.

- “Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher – Drescher’s book offers an accessible entry into the fundamentals of blockchain technology. This resource is ideal for users who seek to comprehend the underlying system powering cryptocurrency-based referral programs.

- “The Basics of Bitcoins and Blockchains” by Antony Lewis – Offering a detailed explanation of both Bitcoin and Blockchain, Lewis’s guide is suitable for anyone looking to explore the intricacies of digital currency systems and their real-world applications.

- “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar – This book explores the broader landscape of participating in and investing in cryptocurrencies. It covers emerging trends and technologies, essential for understanding how digital assets can be leveraged within educational platforms.

- “Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money” by Nathaniel Popper – For readers interested in the historical narrative of Bitcoin’s inception and journey, Popper’s book provides a captivating insight into the rise of cryptocurrencies.

Zearn Referral Code Crypto Pros and Cons

Incorporating cryptocurrency technology into the Zearn referral code system presents both advantages and disadvantages. It’s essential for users to weigh these aspects to understand the potential impact on the educational experience.

Pros

- Enhanced Security: Blockchain technology, which underpins cryptocurrency systems, offers high levels of security, ensuring that referral codes and transactions are protected against fraud.

- Increased Accessibility: Cryptocurrencies can facilitate seamless access to digital resources across borders, making it easier for users from different regions to participate in Zearn’s referral program.

- Innovation in Learning: By integrating cryptocurrencies, Zearn can provide novel learning incentives, potentially increasing student engagement and motivation through digital rewards.

Cons

- Complexity in Usage: The technical nature of cryptocurrencies can be a barrier for some users, particularly those unfamiliar with the technologies involved.

- Volatile Value: The fluctuating value of cryptocurrencies could affect the stability and predictability of rewards in the referral program.

- Regulatory Concerns: The evolving legal landscape around cryptocurrencies may introduce challenges regarding compliance and implementation within educational frameworks.

Zearn Referral Code Crypto FAQs

What is a Zearn Referral Code?

A Zearn referral code is a unique identifier. Users can share it to invite others. It allows people to join the Zearn platform. This often leads to rewards. Both parties involved may receive incentives.

How does cryptocurrency integrate with Zearn’s referral program?

Zearn uses digital tokens as rewards in its referral program. These tokens rely on blockchain technology. This setup offers enhanced security. It also introduces new incentive mechanisms.

Are cryptocurrencies safe for use in educational platforms?

Cryptocurrencies offer strong security features. Users should stay informed about potential risks. Understand the technology’s workings. Make safe and informed decisions.

What if I don’t understand cryptocurrency?

Zearn offers resources for users new to cryptocurrency. They also provide support. They recommend accessing educational materials. This helps build a foundational understanding.

Can anyone participate in the cryptocurrency-based referral system?

Participation may be subject to local cryptocurrency regulations. Check regional guidelines to determine eligibility. Zearn’s referral system is based on cryptocurrencies.

FINANCE

Crypto-Legacy.App Software:Complete Guide

FINANCE

Should I Buy Bitcoin: in 2025? Complete Guide

A Historical Overview and Future Predictions

Should I Buy Bitcoin (BTC), the world’s first decentralized cryptocurrency, continues to attract investors worldwide as it evolves. Since its inception in 2009, Bitcoin has experienced remarkable highs and lows, leaving many to question its future trajectory. In this article, we explore Bitcoin’s historical performance, analyze its recent trends, and provide insights into whether investing in Bitcoin in 2025 is a wise decision.

A Brief History of Bitcoin

The Early Years (2009-2012):

Bitcoin was introduced in 2009 by an anonymous figure or group known as Satoshi Nakamoto. Initially valued at fractions of a cent, Bitcoin gained traction in 2010 when it was first used for a real-world transaction—10,000 BTC for two pizzas. By 2012, Bitcoin reached $13, as awareness and adoption began to grow.

First Boom and Bust (2013-2015):

Bitcoin experienced its first major price surge in 2013, skyrocketing to over $1,000. However, regulatory concerns and the collapse of the Mt. Gox exchange in 2014 caused the price to plummet below $300, highlighting the volatility of this emerging asset.

The 2017 Bull Run:

Bitcoin saw a meteoric rise in 2017, fueled by retail investor interest and growing adoption. Its price peaked near $20,000 in December 2017. However, a sharp correction followed in 2018, with Bitcoin falling to around $3,000 by the end of the year.

The 2020-2021 Explosion:

The COVID-19 pandemic in 2020 marked a turning point for Bitcoin, as institutional investors began to view it as a hedge against inflation. Bitcoin hit an all-time high of nearly $69,000 in November 2021, driven by mainstream adoption and significant investments from companies like Tesla and MicroStrategy.

The 2022 Crypto Winter:

Following its 2021 peak, Bitcoin faced significant challenges in 2022, including rising interest rates, economic uncertainty, and major industry scandals like the collapse of the FTX exchange. Bitcoin’s price fell below $16,000 at its lowest point.

Bitcoin in 2023-2024: Recovery and Consolidation

The crypto market began to stabilize in 2023 as macroeconomic conditions improved. Regulatory clarity in several regions, along with increasing institutional interest, pushed Bitcoin’s price above $35,000 by late 2023. Adoption grew further, with companies like BlackRock filing for Bitcoin spot ETFs, signaling mainstream acceptance.

By 2024, Bitcoin benefited from the hype surrounding its fourth halving event. The halving reduced the block reward from 6.25 BTC to 3.125 BTC, effectively lowering the rate of new Bitcoin issuance. Historically, halving events have preceded significant bull runs, as reduced supply creates scarcity in the market.

Predictions for Bitcoin in 2025

Factors Supporting Growth in 2025:

- Institutional Adoption:

Institutional participation in the Bitcoin market is expected to grow. Bitcoin ETFs and broader acceptance among hedge funds and asset managers could provide a steady influx of capital. - Inflation Hedge:

Amid global economic uncertainties, Bitcoin is increasingly viewed as “digital gold.” Its limited supply of 21 million coins ensures scarcity, making it a potential hedge against inflation. - Global Acceptance:

More countries may follow El Salvador’s example in adopting Bitcoin as legal tender. Blockchain technology’s increasing use in remittances and financial systems could drive demand further. - Technological Advancements:

Bitcoin’s Layer 2 solutions, like the Lightning Network, could improve transaction efficiency and scalability, making Bitcoin more appealing for everyday use.

Potential Risks in 2025:

- Regulatory Challenges:

Governments worldwide continue to grapple with regulating cryptocurrencies. Harsh regulatory actions in major economies could dampen Bitcoin’s growth. - Competition from Altcoins and CBDCs:

Alternative cryptocurrencies and Central Bank Digital Currencies (CBDCs) could compete with Bitcoin, particularly in the realm of payments and smart contracts. - Volatility:

Bitcoin’s price volatility remains a concern. While it presents opportunities for profit, it also increases risks for new investors.

Predicted Price Range for 2025:

Experts offer varied predictions for Bitcoin’s price in 2025, ranging from $100,000 to $250,000, assuming continued adoption and positive macroeconomic trends. However, some caution that a significant market downturn could see Bitcoin trading closer to $50,000.

Should You Buy Bitcoin in 2025?

Whether Bitcoin is a good investment in 2025 depends on your financial goals, risk tolerance, and investment strategy. Here are key points to consider:

- Long-Term Investment:

Bitcoin’s limited supply and growing institutional adoption make it an attractive long-term asset. Investors with a high-risk tolerance and a belief in Bitcoin’s future utility may find it worthwhile. - Diversification:

Bitcoin can serve as a diversification tool in a broader investment portfolio, balancing traditional assets like stocks and bonds. - Risk Management:

Due to its volatility, experts recommend allocating no more than 5-10% of your portfolio to Bitcoin.

Summary

Bitcoin’s journey from an obscure digital asset to a trillion-dollar market leader highlights its transformative potential. While the past demonstrates Bitcoin’s resilience, future success hinges on adoption, regulatory clarity, and technological advancements.

Investing in Bitcoin in 2025 could yield substantial rewards, but it comes with inherent risks. As with any investment, conducting thorough research and consulting with financial advisors is essential.

References

- Nakamoto, S. (2009). Bitcoin: A Peer-to-Peer Electronic Cash System.

- “Bitcoin Price History: A Timeline of Key Events.” Investopedia.

- “What to Expect from Bitcoin After the 2024 Halving.” CoinDesk.

- “Institutional Adoption of Bitcoin: 2025 Predictions.” Bloomberg.

- “The Role of Bitcoin in Diversified Portfolios.” Forbes.

Historical Performance: The Rollercoaster Ride

Bitcoin’s journey has been marked by incredible volatility. After its inception in 2009, Bitcoin’s value surged from less than $1 to nearly $20,000 in 2017. Following a severe correction, it rebounded, peaking at nearly $69,000 in late 2021 during the bull market. However, the 2022 bear market saw it dip below $20,000. By 2024, Bitcoin recovered dramatically, trading around $90,000 and nearing the $100,000 milestone【13】【14】.

Current Trends in 2024

- Institutional Adoption: The approval of spot Bitcoin ETFs in January 2024 significantly boosted institutional interest, with inflows exceeding $6 billion. Major players like BlackRock and Fidelity now offer Bitcoin-related financial products, contributing to mainstream adoption【13】【14】.

- Halving Impact: The April 2024 Bitcoin halving, which reduced mining rewards, historically triggers price surges by limiting supply. Analysts expect this event to be a key driver for 2025 price growth【14】【15】.

- Regulatory Environment: A more crypto-friendly U.S. administration under President-elect Donald Trump has bolstered optimism. Policies supporting Bitcoin adoption as a reserve asset could further solidify its role in global finance【13】【14】.

Expert Predictions for 2025

Predictions for Bitcoin’s price in 2025 vary widely:

- Bullish Projections: Analysts like Michael Saylor and Tim Draper foresee Bitcoin hitting $250,000 or more, citing increasing adoption and its scarcity-driven value proposition【13】【15】.

- Conservative Estimates: Institutions like Standard Chartered and Pantera Capital predict prices in the range of $115,000 to $200,000【14】【15】.

- Optimistic Scenarios: Some experts, including PlanB and Arthur Hayes, envision Bitcoin reaching $1 million under favorable economic and regulatory conditions【14】【15】.

Factors Influencing Bitcoin’s Future

- Macroeconomic Conditions: Rising inflation and concerns over fiat currency devaluation make Bitcoin an attractive hedge.

- Spot ETF Growth: Continued adoption of Bitcoin ETFs will likely attract more institutional investors.

- Regulatory Clarity: Supportive policies could pave the way for broader adoption, while restrictive ones may limit growth.

- Market Cycles: Bitcoin’s cyclical nature often leads to price spikes post-halving events【14】【15】.

Risks to Consider

- Volatility: Bitcoin remains highly volatile, and substantial price swings are expected.

- Regulatory Challenges: Unexpected restrictions in major markets could adversely impact Bitcoin’s growth.

- Market Saturation: Overreliance on institutional demand could lead to slower growth if demand plateaus【14】【15】.

Should You Buy Bitcoin?

Bitcoin’s strong fundamentals and growing institutional backing make it a compelling investment for 2025. However, its volatility and uncertain regulatory environment demand careful consideration. Diversifying your portfolio and consulting with a financial advisor are crucial before making a decision.

For more insights, explore detailed forecasts on platforms like CoinMarketCap and KuCoin.

Blog

fintechzoom.com crypto market cap: latest

Exploring the Crypto Market Cap Insights on FintechZoom.com

fintechzoom.com crypto market cap The cryptocurrency market has emerged as a key player in modern finance, with its market cap showcasing trends that attract both novice and seasoned investors. FintechZoom provides a detailed and analytical perspective on this rapidly evolving industry, focusing on market capitalization, regulatory challenges, and investment strategies.

The Current State of the Crypto Market

As of 2024, the global cryptocurrency market cap has exceeded $1.8 trillion, reflecting a compound annual growth rate (CAGR) of 11.1% since 2018. This surge is attributed to increasing institutional adoption, the rise of decentralized finance (DeFi), and growing interest in blockchain applications【104†source】【105†source】.

Key Features of FintechZoom’s Crypto Market Analysis

- Price and Market Analysis:

FintechZoom tracks price movements of leading cryptocurrencies like Bitcoin, Ethereum, and Cardano. Analysts delve into trends, enabling informed decision-making for traders and investors【104†source】【105†source】. - Blockchain Innovations:

Reports highlight advancements in blockchain technology, emphasizing its applications beyond cryptocurrency in sectors like healthcare, supply chain, and finance. - Regulatory Updates:

The site details global regulatory shifts affecting cryptocurrencies, such as the United States Securities and Exchange Commission (SEC)’s stance on token classifications and international tax reforms impacting crypto trading【105†source】. - Expert Insights:

Regular expert interviews provide nuanced views on market dynamics and strategic investment【104†source】.

Market Players and Trends

Top 10 Most Important Points About the Crypto Market Cap

- Definition and Significance

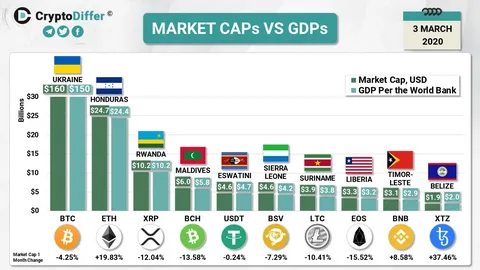

Crypto market capitalization is the total value of all cryptocurrencies in circulation. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. This metric provides insight into the overall size and health of the crypto market【104†source】【105†source】. - Market Leaders by Market Cap

Bitcoin (BTC) and Ethereum (ETH) dominate the market, accounting for over 60% of the total crypto market capitalization as of 2024. Their dominance reflects their widespread adoption and use cases【104†source】. - Volatility and Trends

Cryptocurrencies are highly volatile, with market caps fluctuating rapidly due to changes in investor sentiment, regulatory news, and macroeconomic factors. This volatility offers high-risk, high-reward opportunities for investors【105†source】. - Impact of Institutional Investment

Institutional investors are driving market growth, with Bitcoin ETFs and corporate investments into blockchain technology bolstering market capitalization. The approval of spot Bitcoin ETFs in early 2024 exemplifies this trend【105†source】. - Role of Decentralized Finance (DeFi)

DeFi applications, which allow users to borrow, lend, and trade without intermediaries, have significantly contributed to the market cap of cryptocurrencies like Ethereum and Solana【104†source】. - Regulatory Challenges and Adaptations

Regulatory clarity remains a pivotal factor influencing market cap. Countries with clear crypto regulations, such as Japan and Switzerland, have seen higher adoption rates and more stable market growth【105†source】. -

Correlation with Traditional Markets

Cryptocurrencies show lower correlation with traditional financial markets, making them an attractive asset class for diversification. This independence, however, also contributes to their volatility【105†source】. - Emergence of Stablecoins

Stablecoins like Tether (USDT) and USD Coin (USDC) are key players in the crypto market. Their market caps are growing due to their use in trading and as a store of value amid market volatility【105†source】. - Global Adoption Trends

Emerging economies are leading in crypto adoption, using digital currencies as alternatives to unstable fiat currencies. Countries like Nigeria and El Salvador are notable examples【104†source】. - Technological Advancements

Innovations in blockchain scalability, such as Ethereum’s transition to a proof-of-stake consensus mechanism, have positively influenced the market cap by attracting environmentally conscious investors and reducing energy consumption【105†source】.

References

- Crypto FintechZoom: Market Overview

- CoinMarketCap: Comprehensive Market Data

- Investopedia: Understanding Cryptocurrency Market Cap

These points highlight the dynamic nature of the cryptocurrency market and the factors influencing its market cap. For detailed insights, refer to resources like FintechZoom and CoinMarketCap.

| Category | Top Players | Description |

|---|---|---|

| Cryptocurrencies | Bitcoin, Ethereum, Solana | Leading assets by market capitalization. |

| Exchanges | Coinbase, Binance, Kraken | Platforms for buying, selling, and trading crypto. |

| Blockchain Firms | ConsenSys, Hyperledger | Innovators in blockchain infrastructure development. |

Challenges and Future Outlook

- Volatility: Cryptocurrency markets are known for extreme price swings, presenting both opportunities and risks for investors.

- Regulation: Inconsistent global regulatory frameworks create uncertainty for users and businesses【105†source】.

- Adoption: Emerging markets are experiencing rapid adoption, driven by decentralized applications and accessibility.

Latest Research and Expert Verdicts

Recent research emphasizes the impact of regulatory clarity on market stability. Analysts forecast further institutional adoption if regulatory challenges are addressed effectively. Financial experts suggest that diversification within crypto portfolios and cautious investment in tokenized assets can mitigate risks while capitalizing on growth opportunities【105†source】.

Detailed FAQs About the Crypto Market Cap

1. What is crypto market cap, and why is it important?

The cryptocurrency market cap is the total value of a cryptocurrency or the entire market. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. It provides a snapshot of the market’s size and health, helping investors compare different cryptocurrencies and track growth over time【104†source】【105†source】.

2. What is the difference between circulating supply and total supply?

- Circulating Supply: The number of coins or tokens actively available in the market.

- Total Supply: The total amount of coins or tokens that exist, including those not yet released or locked.

The market cap is typically calculated using the circulating supply, as it reflects the available tradable value of a cryptocurrency【105†source】.

3. How does the crypto market cap compare to traditional markets?

The global crypto market cap is smaller than traditional markets like stocks or bonds. However, its growth rate is significantly higher due to innovations in blockchain technology and increasing adoption by both retail and institutional investors【105†source】【104†source】.

4. Which cryptocurrencies have the highest market caps?

As of 2024, Bitcoin (BTC) and Ethereum (ETH) lead the market, followed by stablecoins like Tether (USDT) and altcoins like Binance Coin (BNB) and Solana (SOL)【105†source】.

5. What factors influence the market cap of a cryptocurrency?

Several factors impact market capitalization, including:

- Price fluctuations.

- Adoption rates and utility of the cryptocurrency.

- Supply dynamics, including token burns or minting.

- Investor sentiment and market trends【105†source】【104†source】.

6. What is the impact of regulatory changes on market cap?

Regulatory clarity can boost market confidence, encouraging investment and driving growth in market cap. Conversely, restrictive regulations or uncertainty can lead to market cap declines as investors retreat【105†source】.

7. How is market cap different from fully diluted valuation (FDV)?

- Market Cap: Uses the circulating supply to calculate the value.

- FDV: Considers the total supply (including locked or unreleased tokens) to estimate the potential maximum value of a cryptocurrency【105†source】.

8. Why are stablecoins significant in the market cap rankings?

Stablecoins like USDT and USDC provide liquidity to the market and are widely used for trading and as a hedge against volatility. Their steady values contribute significantly to the market’s stability【105†source】【104†source】.

9. Can market cap predict the future price of a cryptocurrency?

Market cap provides a measure of size and popularity but does not guarantee future price performance. Other factors like utility, technological advancements, and market sentiment play critical roles【104†source】.

10. How can investors use market cap data effectively?

Investors use market cap data to:

- Compare the relative size of cryptocurrencies.

- Identify growth opportunities by analyzing smaller-cap coins with potential.

- Assess the risk level—larger caps are typically less volatile but have slower growth【105†source】.

For further reading and in-depth analysis, consult resources like FintechZoom, CoinMarketCap, and Investopedia.

This overview demonstrates FintechZoom’s critical role in providing comprehensive coverage of the cryptocurrency market. For additional information, you can explore FintechZoom’s official website and related resources【105†source】.

-

SEO3 months ago

SEO3 months agoBest website platform for seo: top 5 popular websites, 1-book, 25 Top Free SEO Tools,

-

Blog5 months ago

Blog5 months agoMaria Taylor’s Husband: Jonathan Lee Hemphill’s Job, Family, and Kids Explained

-

FASHION2 months ago

FASHION2 months agoOld-Fashioned: Styles Across Generation

-

SEO3 months ago

SEO3 months agoGoogle Ranking Factors: top 50 factors

-

TECH2 months ago

TECH2 months agoRadiology Tech: Prices, Features, and Buy

-

Blog2 months ago

Blog2 months agoSigns of a Healthy Relationship:

-

YOGA2 months ago

YOGA2 months agoDental Care: Can Increase Your Life Expectancy

-

SEO3 months ago

SEO3 months agoDoes google business profile posting improve rankings: A Latest Guide to Google Visibility books