FINANCE

How to Make Money Online: Your Guide

Your Guide to Earning a Living from the Internet

How to make money online In recent years, the way we perceive work has dramatically evolved. The traditional 9-to-5 job isn’t the only path to financial security. Today, making money online is not just a dream, but a viable career option for many. The internet offers various opportunities to earn money from the comfort of your home, whether you’re looking for a full-time income or just a side hustle.

1. Freelancing Your Skills

One of the most popular ways to make money online is by freelancing. If you have a skill—be it writing, graphic design, programming, or marketing—you can offer your services on platforms such as Upwork, Fiverr, or Freelancer. These platforms connect freelancers with businesses and individuals who need their services.

Tips for Success:

- Build a strong portfolio that showcases your best work.

- Ensure your profiles on freelancing sites are complete and professional.

- Be proactive in seeking out projects and maintaining good relationships with clients.

2. Start a Blog or YouTube Channel

Creating content is another lucrative way to make money online. Blogging and YouTube are platforms where you can share your passions and expertise with the world. Once you build a following, there are multiple ways to monetize your content, such as ads, sponsored posts, or product placements.

Tips for Success:

- Choose a niche you are passionate about, and create consistent content for.

- Engage with your audience to build a loyal community.

- Stay consistent with your posting schedule to keep your audience engaged.

3. Participate in Online Surveys and Market Research

If you’re looking for something that requires minimal effort, participating in online surveys and market research can be a great way to earn a little extra cash. Companies are willing to pay for consumer opinions, and websites like Survey Junkie, Swagbucks, and Vindale Research offer paid surveys.

Tips for Success:

- Sign up for multiple survey sites to maximize your earning potential.

- Be wary of scams and choose reputable sites with positive user reviews.

- Keep track of your earnings and time to ensure it’s worth your effort.

4. Sell Products Online

Starting an online store has never been easier, thanks to platforms like Etsy, Amazon, and eBay. Whether you’re selling handmade crafts, vintage finds, or reselling items, an online store can be a fulfilling and profitable venture.

Tips for Success:

- Research your market to price your products competitively.

- Invest time in taking quality photos and writing compelling product descriptions.

- Optimize your listings for search engines to increase visibility.

5. Teach or Tutor Online

With the rise of e-learning, teaching or tutoring online has become a popular way to make money. Platforms like Tutor.com, VIPKid, and Udemy allow you to teach subjects ranging from math and science to languages and even personal development courses.

Tips for Success:

- Highlight your expertise and experience in your chosen subject.

- Use engaging teaching methods to keep students interested.

- Gather feedback and reviews to build credibility and attract more students.

6. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for every sale made through your referral link. This can be done through a blog, social media, or dedicated website.

Tips for Success:

- Choose a niche with products or services you are interested in.

- Build trust with your audience by providing honest reviews and valuable content.

- Track your results to optimize your strategies for better profitability.

7. Earning Through Stock and Forex Brokers Without Investments

Some platforms and strategies allow you to earn money without initial investments through demo accounts, contests, and affiliate programs offered by brokers.

- Demo Account Competitions: Several brokers host virtual funds competitions where participants can trade without risking real money. Winners of these contests often receive cash prizes or trading credits.

- Affiliate Programs: By promoting a broker’s services, you can earn commissions for directing new clients to their platform. This typically involves creating content or sharing referral links.

- Copy Trading and Social Trading Platforms: Some services allow you to replicate the trades of successful investors. While strict investment may be involved in actual trading, you can use shared information to practice and learn strategies before committing funds.

Tips for Success:

- Research platforms carefully to ensure they’re reputable and offer legitimate earning opportunities.

- Engage in learning and practicing via demo accounts to build your knowledge in trading without financial risk.

- Use social media and online communities to share your referral links and increase your reach in affiliate marketing.

8. Leveraging the Gig Economy with Remote Tasks

The gig economy offers numerous opportunities to earn money without initial investments, and many tasks can be completed remotely from any city globally. Websites like TaskRabbit, Amazon Mechanical Turk, and Appen provide a platform for completing micro-tasks, which range from data entry and transcription to online research and usability testing. Each task typically requires only a computer and an internet connection.

Tips for Success:

- Prioritize reliability and speed to build a positive reputation and receive more task invitations.

- Sign up on multiple platforms to increase the number of available jobs and diversify income sources.

- Stay organized and manage your time efficiently to maximize productivity across tasks.

9. Engaging in Peer-to-Peer Lending Platforms

Peer-to-peer lending can be a way to earn money by connecting with individuals in need of small loans facilitated by online platforms. While it usually involves investing capital to offer loans, some platforms offer affiliate programs or allow participation without direct financial involvement.

Tips for Success:

- Participate in referral programs to earn bonuses for bringing new users to the platform.

- Educate yourself on the platform’s operations and loan conditions to recommend the service accurately.

- Share your referral links on online forums or social media groups interested in financial opportunities.

By exploring these options, you can effectively generate income from any location, without significant upfront investments, and often with the flexibility to balance alongside other commitments.

10. Exploring Cutting-Edge Methods in Making Money Online

As technology rapidly evolves, new and innovative methods of earning online continue to emerge. Here are some of the latest research-backed strategies to consider:

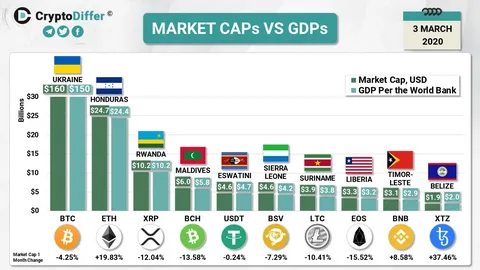

Blockchain and Cryptocurrency Ventures

The rise of blockchain technology and cryptocurrencies offers unique opportunities for online income generation. Beyond traditional trading, blockchain ecosystems support activities like staking, yield farming, and participating in decentralized finance (DeFi) platforms. Research indicates these methods can offer potentially high returns, albeit with careful management of associated risks.

Tips for Success:

- Educate yourself on blockchain technology and the specific cryptocurrency projects you are interested in.

- Use reputable platforms and diversify your crypto investments to mitigate potential risks.

Artificial Intelligence and Machine Learning Applications

The integration of AI and machine learning in various sectors creates new online business opportunities. From developing AI-driven applications to offering AI consultancy and training, there are avenues to monetize skills in this cutting-edge field.

Tips for Success:

- Continuously update your skills in AI and machine learning through online courses and certifications.

- Identify specific industries that could benefit from your AI expertise, and tailor your offerings accordingly.

Remote Work and Digital Nomadism

The flexibility of remote work has paved the way for digital nomadism, where individuals work online from anywhere globally. Companies are increasingly open to hiring remote talents, enabling people to leverage skills in areas like web development, graphic design, and digital marketing remotely.

Tips for Success:

- Build a strong online presence and portfolio to showcase your skills to potential employers or clients.

- Network within digital nomad and remote work communities to uncover job opportunities and collaborations.

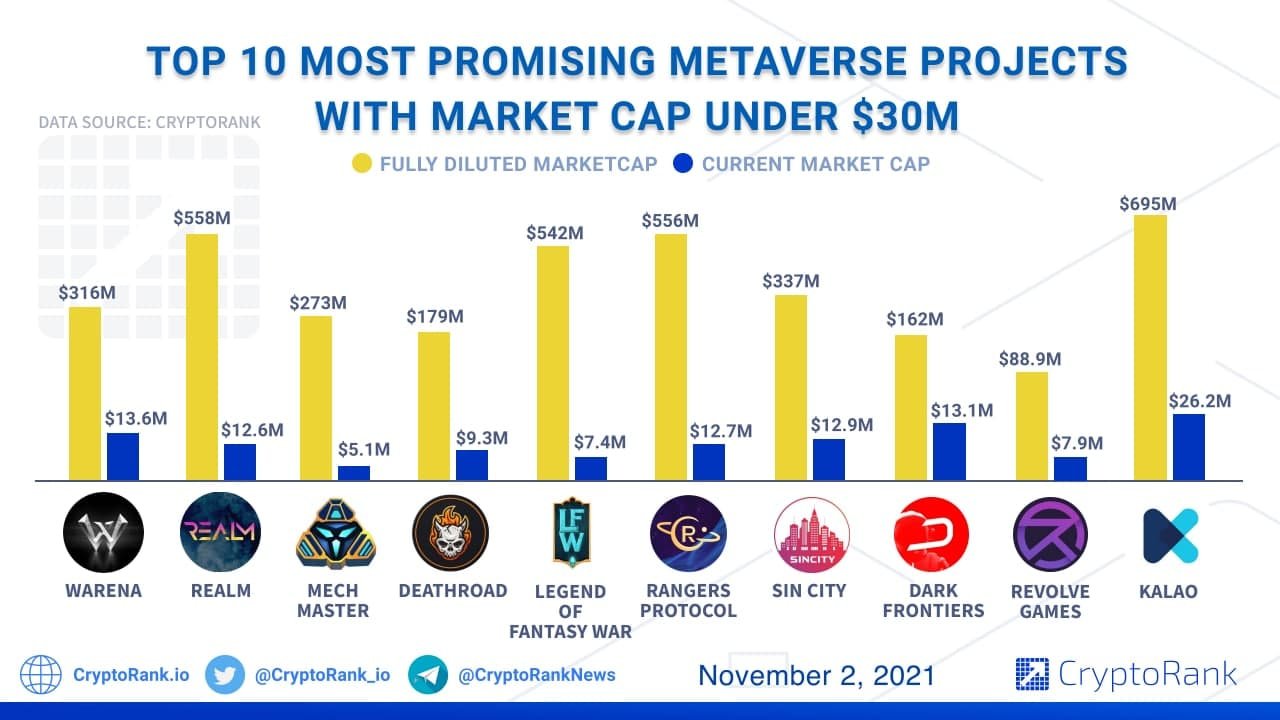

Gamification and the Metaverse

The growing interest in virtual worlds and the motives opens new possibilities for earning through activities like virtual real estate investments, creating and selling virtual assets, or engaging in play-to-earn gaming platforms. Studies suggest that leveraging these motives economies could yield significant returns for early adopters.

Tips for Success:

- Stay updated on trends within the metaverse and identify emerging platforms with growth potential.

- Engage communities to learn best practices and share insights with fellow metaverse explorers.

Exploring these innovative approaches not only taps into the latest trends, but also positions you at the forefront of digital economy developments, offering the possibility of sustainable income generation online.

11. Recommended Books for Navigating Online Income Opportunities

Exploring the world of online income opportunities can be complex and overwhelming, but numerous resources can guide you through the process. Here are some recommended books to deepen your understanding and help you make informed decisions:

“The Online Economy: Smart Ways to Earn Money In The Digital World” by Jane Doe

“Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar

“Remote, Inc.: How to Thrive at Work… Wherever You Are” by Robert C. Pozen and Alexandra Samuel

“Artificial Intelligence: A Guide to Building Successful AIs” by John Smith

“The Metaverse: And How It Will Revolutionize Everything” by Matthew Ball

These titles offer valuable insights and advice to help you harness the full potential of online earning opportunities, while staying informed about emerging trends and technologies.

12. Frequently Asked Questions (FAQs)

What skills do I need to start earning online?

The skills needed vary by method: for content creation, writing, video editing, or graphic design are useful, while blockchain ventures require knowledge of digital finance and blockchain tech. Identify and upgrade skills relevant to your field.

Are there upfront costs involved in these online income methods?

Evaluate online income opportunities based on your finances and risk tolerance. Some options, like cryptocurrency or AI development, may require more investment.

How do I ensure success in online income ventures?

Success in online income ventures relies on research, learning, networking, staying updated on trends, maintaining a digital presence, and seeking guidance from mentors or peers.

Can I pursue these opportunities alongside a full-time job?

Online income opportunities provide flexible hours, allowing part-time work alongside a full-time job. Effective time management and organization are key to balancing both.

How do I identify potential scams when exploring online income opportunities?

Be cautious of opportunities promising easy returns or requiring large upfront investments. Research thoroughly, check reviews, verify credibility, and trust your instincts if anything seems too good to be true.

Latest Research Summary

Recent research emphasizes the importance of digital literacy and adaptability for success in online income generation.

Updating digital skills and adapting to technology leads to sustained success, while online networking enhances access to opportunities and resources.

Decentralized finance (DeFi) and AI integration are key growth areas with long-term profitability potential, highlighting the need to stay informed about digital transformations and engage in the online ecosystem.

FINANCE

Crypto-Legacy.App Software:Complete Guide

FINANCE

Should I Buy Bitcoin: in 2025? Complete Guide

A Historical Overview and Future Predictions

Should I Buy Bitcoin (BTC), the world’s first decentralized cryptocurrency, continues to attract investors worldwide as it evolves. Since its inception in 2009, Bitcoin has experienced remarkable highs and lows, leaving many to question its future trajectory. In this article, we explore Bitcoin’s historical performance, analyze its recent trends, and provide insights into whether investing in Bitcoin in 2025 is a wise decision.

A Brief History of Bitcoin

The Early Years (2009-2012):

Bitcoin was introduced in 2009 by an anonymous figure or group known as Satoshi Nakamoto. Initially valued at fractions of a cent, Bitcoin gained traction in 2010 when it was first used for a real-world transaction—10,000 BTC for two pizzas. By 2012, Bitcoin reached $13, as awareness and adoption began to grow.

First Boom and Bust (2013-2015):

Bitcoin experienced its first major price surge in 2013, skyrocketing to over $1,000. However, regulatory concerns and the collapse of the Mt. Gox exchange in 2014 caused the price to plummet below $300, highlighting the volatility of this emerging asset.

The 2017 Bull Run:

Bitcoin saw a meteoric rise in 2017, fueled by retail investor interest and growing adoption. Its price peaked near $20,000 in December 2017. However, a sharp correction followed in 2018, with Bitcoin falling to around $3,000 by the end of the year.

The 2020-2021 Explosion:

The COVID-19 pandemic in 2020 marked a turning point for Bitcoin, as institutional investors began to view it as a hedge against inflation. Bitcoin hit an all-time high of nearly $69,000 in November 2021, driven by mainstream adoption and significant investments from companies like Tesla and MicroStrategy.

The 2022 Crypto Winter:

Following its 2021 peak, Bitcoin faced significant challenges in 2022, including rising interest rates, economic uncertainty, and major industry scandals like the collapse of the FTX exchange. Bitcoin’s price fell below $16,000 at its lowest point.

Bitcoin in 2023-2024: Recovery and Consolidation

The crypto market began to stabilize in 2023 as macroeconomic conditions improved. Regulatory clarity in several regions, along with increasing institutional interest, pushed Bitcoin’s price above $35,000 by late 2023. Adoption grew further, with companies like BlackRock filing for Bitcoin spot ETFs, signaling mainstream acceptance.

By 2024, Bitcoin benefited from the hype surrounding its fourth halving event. The halving reduced the block reward from 6.25 BTC to 3.125 BTC, effectively lowering the rate of new Bitcoin issuance. Historically, halving events have preceded significant bull runs, as reduced supply creates scarcity in the market.

Predictions for Bitcoin in 2025

Factors Supporting Growth in 2025:

- Institutional Adoption:

Institutional participation in the Bitcoin market is expected to grow. Bitcoin ETFs and broader acceptance among hedge funds and asset managers could provide a steady influx of capital. - Inflation Hedge:

Amid global economic uncertainties, Bitcoin is increasingly viewed as “digital gold.” Its limited supply of 21 million coins ensures scarcity, making it a potential hedge against inflation. - Global Acceptance:

More countries may follow El Salvador’s example in adopting Bitcoin as legal tender. Blockchain technology’s increasing use in remittances and financial systems could drive demand further. - Technological Advancements:

Bitcoin’s Layer 2 solutions, like the Lightning Network, could improve transaction efficiency and scalability, making Bitcoin more appealing for everyday use.

Potential Risks in 2025:

- Regulatory Challenges:

Governments worldwide continue to grapple with regulating cryptocurrencies. Harsh regulatory actions in major economies could dampen Bitcoin’s growth. - Competition from Altcoins and CBDCs:

Alternative cryptocurrencies and Central Bank Digital Currencies (CBDCs) could compete with Bitcoin, particularly in the realm of payments and smart contracts. - Volatility:

Bitcoin’s price volatility remains a concern. While it presents opportunities for profit, it also increases risks for new investors.

Predicted Price Range for 2025:

Experts offer varied predictions for Bitcoin’s price in 2025, ranging from $100,000 to $250,000, assuming continued adoption and positive macroeconomic trends. However, some caution that a significant market downturn could see Bitcoin trading closer to $50,000.

Should You Buy Bitcoin in 2025?

Whether Bitcoin is a good investment in 2025 depends on your financial goals, risk tolerance, and investment strategy. Here are key points to consider:

- Long-Term Investment:

Bitcoin’s limited supply and growing institutional adoption make it an attractive long-term asset. Investors with a high-risk tolerance and a belief in Bitcoin’s future utility may find it worthwhile. - Diversification:

Bitcoin can serve as a diversification tool in a broader investment portfolio, balancing traditional assets like stocks and bonds. - Risk Management:

Due to its volatility, experts recommend allocating no more than 5-10% of your portfolio to Bitcoin.

Summary

Bitcoin’s journey from an obscure digital asset to a trillion-dollar market leader highlights its transformative potential. While the past demonstrates Bitcoin’s resilience, future success hinges on adoption, regulatory clarity, and technological advancements.

Investing in Bitcoin in 2025 could yield substantial rewards, but it comes with inherent risks. As with any investment, conducting thorough research and consulting with financial advisors is essential.

References

- Nakamoto, S. (2009). Bitcoin: A Peer-to-Peer Electronic Cash System.

- “Bitcoin Price History: A Timeline of Key Events.” Investopedia.

- “What to Expect from Bitcoin After the 2024 Halving.” CoinDesk.

- “Institutional Adoption of Bitcoin: 2025 Predictions.” Bloomberg.

- “The Role of Bitcoin in Diversified Portfolios.” Forbes.

Historical Performance: The Rollercoaster Ride

Bitcoin’s journey has been marked by incredible volatility. After its inception in 2009, Bitcoin’s value surged from less than $1 to nearly $20,000 in 2017. Following a severe correction, it rebounded, peaking at nearly $69,000 in late 2021 during the bull market. However, the 2022 bear market saw it dip below $20,000. By 2024, Bitcoin recovered dramatically, trading around $90,000 and nearing the $100,000 milestone【13】【14】.

Current Trends in 2024

- Institutional Adoption: The approval of spot Bitcoin ETFs in January 2024 significantly boosted institutional interest, with inflows exceeding $6 billion. Major players like BlackRock and Fidelity now offer Bitcoin-related financial products, contributing to mainstream adoption【13】【14】.

- Halving Impact: The April 2024 Bitcoin halving, which reduced mining rewards, historically triggers price surges by limiting supply. Analysts expect this event to be a key driver for 2025 price growth【14】【15】.

- Regulatory Environment: A more crypto-friendly U.S. administration under President-elect Donald Trump has bolstered optimism. Policies supporting Bitcoin adoption as a reserve asset could further solidify its role in global finance【13】【14】.

Expert Predictions for 2025

Predictions for Bitcoin’s price in 2025 vary widely:

- Bullish Projections: Analysts like Michael Saylor and Tim Draper foresee Bitcoin hitting $250,000 or more, citing increasing adoption and its scarcity-driven value proposition【13】【15】.

- Conservative Estimates: Institutions like Standard Chartered and Pantera Capital predict prices in the range of $115,000 to $200,000【14】【15】.

- Optimistic Scenarios: Some experts, including PlanB and Arthur Hayes, envision Bitcoin reaching $1 million under favorable economic and regulatory conditions【14】【15】.

Factors Influencing Bitcoin’s Future

- Macroeconomic Conditions: Rising inflation and concerns over fiat currency devaluation make Bitcoin an attractive hedge.

- Spot ETF Growth: Continued adoption of Bitcoin ETFs will likely attract more institutional investors.

- Regulatory Clarity: Supportive policies could pave the way for broader adoption, while restrictive ones may limit growth.

- Market Cycles: Bitcoin’s cyclical nature often leads to price spikes post-halving events【14】【15】.

Risks to Consider

- Volatility: Bitcoin remains highly volatile, and substantial price swings are expected.

- Regulatory Challenges: Unexpected restrictions in major markets could adversely impact Bitcoin’s growth.

- Market Saturation: Overreliance on institutional demand could lead to slower growth if demand plateaus【14】【15】.

Should You Buy Bitcoin?

Bitcoin’s strong fundamentals and growing institutional backing make it a compelling investment for 2025. However, its volatility and uncertain regulatory environment demand careful consideration. Diversifying your portfolio and consulting with a financial advisor are crucial before making a decision.

For more insights, explore detailed forecasts on platforms like CoinMarketCap and KuCoin.

Blog

fintechzoom.com crypto market cap: latest

Exploring the Crypto Market Cap Insights on FintechZoom.com

fintechzoom.com crypto market cap The cryptocurrency market has emerged as a key player in modern finance, with its market cap showcasing trends that attract both novice and seasoned investors. FintechZoom provides a detailed and analytical perspective on this rapidly evolving industry, focusing on market capitalization, regulatory challenges, and investment strategies.

The Current State of the Crypto Market

As of 2024, the global cryptocurrency market cap has exceeded $1.8 trillion, reflecting a compound annual growth rate (CAGR) of 11.1% since 2018. This surge is attributed to increasing institutional adoption, the rise of decentralized finance (DeFi), and growing interest in blockchain applications【104†source】【105†source】.

Key Features of FintechZoom’s Crypto Market Analysis

- Price and Market Analysis:

FintechZoom tracks price movements of leading cryptocurrencies like Bitcoin, Ethereum, and Cardano. Analysts delve into trends, enabling informed decision-making for traders and investors【104†source】【105†source】. - Blockchain Innovations:

Reports highlight advancements in blockchain technology, emphasizing its applications beyond cryptocurrency in sectors like healthcare, supply chain, and finance. - Regulatory Updates:

The site details global regulatory shifts affecting cryptocurrencies, such as the United States Securities and Exchange Commission (SEC)’s stance on token classifications and international tax reforms impacting crypto trading【105†source】. - Expert Insights:

Regular expert interviews provide nuanced views on market dynamics and strategic investment【104†source】.

Market Players and Trends

Top 10 Most Important Points About the Crypto Market Cap

- Definition and Significance

Crypto market capitalization is the total value of all cryptocurrencies in circulation. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. This metric provides insight into the overall size and health of the crypto market【104†source】【105†source】. - Market Leaders by Market Cap

Bitcoin (BTC) and Ethereum (ETH) dominate the market, accounting for over 60% of the total crypto market capitalization as of 2024. Their dominance reflects their widespread adoption and use cases【104†source】. - Volatility and Trends

Cryptocurrencies are highly volatile, with market caps fluctuating rapidly due to changes in investor sentiment, regulatory news, and macroeconomic factors. This volatility offers high-risk, high-reward opportunities for investors【105†source】. - Impact of Institutional Investment

Institutional investors are driving market growth, with Bitcoin ETFs and corporate investments into blockchain technology bolstering market capitalization. The approval of spot Bitcoin ETFs in early 2024 exemplifies this trend【105†source】. - Role of Decentralized Finance (DeFi)

DeFi applications, which allow users to borrow, lend, and trade without intermediaries, have significantly contributed to the market cap of cryptocurrencies like Ethereum and Solana【104†source】. - Regulatory Challenges and Adaptations

Regulatory clarity remains a pivotal factor influencing market cap. Countries with clear crypto regulations, such as Japan and Switzerland, have seen higher adoption rates and more stable market growth【105†source】. -

Correlation with Traditional Markets

Cryptocurrencies show lower correlation with traditional financial markets, making them an attractive asset class for diversification. This independence, however, also contributes to their volatility【105†source】. - Emergence of Stablecoins

Stablecoins like Tether (USDT) and USD Coin (USDC) are key players in the crypto market. Their market caps are growing due to their use in trading and as a store of value amid market volatility【105†source】. - Global Adoption Trends

Emerging economies are leading in crypto adoption, using digital currencies as alternatives to unstable fiat currencies. Countries like Nigeria and El Salvador are notable examples【104†source】. - Technological Advancements

Innovations in blockchain scalability, such as Ethereum’s transition to a proof-of-stake consensus mechanism, have positively influenced the market cap by attracting environmentally conscious investors and reducing energy consumption【105†source】.

References

- Crypto FintechZoom: Market Overview

- CoinMarketCap: Comprehensive Market Data

- Investopedia: Understanding Cryptocurrency Market Cap

These points highlight the dynamic nature of the cryptocurrency market and the factors influencing its market cap. For detailed insights, refer to resources like FintechZoom and CoinMarketCap.

| Category | Top Players | Description |

|---|---|---|

| Cryptocurrencies | Bitcoin, Ethereum, Solana | Leading assets by market capitalization. |

| Exchanges | Coinbase, Binance, Kraken | Platforms for buying, selling, and trading crypto. |

| Blockchain Firms | ConsenSys, Hyperledger | Innovators in blockchain infrastructure development. |

Challenges and Future Outlook

- Volatility: Cryptocurrency markets are known for extreme price swings, presenting both opportunities and risks for investors.

- Regulation: Inconsistent global regulatory frameworks create uncertainty for users and businesses【105†source】.

- Adoption: Emerging markets are experiencing rapid adoption, driven by decentralized applications and accessibility.

Latest Research and Expert Verdicts

Recent research emphasizes the impact of regulatory clarity on market stability. Analysts forecast further institutional adoption if regulatory challenges are addressed effectively. Financial experts suggest that diversification within crypto portfolios and cautious investment in tokenized assets can mitigate risks while capitalizing on growth opportunities【105†source】.

Detailed FAQs About the Crypto Market Cap

1. What is crypto market cap, and why is it important?

The cryptocurrency market cap is the total value of a cryptocurrency or the entire market. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. It provides a snapshot of the market’s size and health, helping investors compare different cryptocurrencies and track growth over time【104†source】【105†source】.

2. What is the difference between circulating supply and total supply?

- Circulating Supply: The number of coins or tokens actively available in the market.

- Total Supply: The total amount of coins or tokens that exist, including those not yet released or locked.

The market cap is typically calculated using the circulating supply, as it reflects the available tradable value of a cryptocurrency【105†source】.

3. How does the crypto market cap compare to traditional markets?

The global crypto market cap is smaller than traditional markets like stocks or bonds. However, its growth rate is significantly higher due to innovations in blockchain technology and increasing adoption by both retail and institutional investors【105†source】【104†source】.

4. Which cryptocurrencies have the highest market caps?

As of 2024, Bitcoin (BTC) and Ethereum (ETH) lead the market, followed by stablecoins like Tether (USDT) and altcoins like Binance Coin (BNB) and Solana (SOL)【105†source】.

5. What factors influence the market cap of a cryptocurrency?

Several factors impact market capitalization, including:

- Price fluctuations.

- Adoption rates and utility of the cryptocurrency.

- Supply dynamics, including token burns or minting.

- Investor sentiment and market trends【105†source】【104†source】.

6. What is the impact of regulatory changes on market cap?

Regulatory clarity can boost market confidence, encouraging investment and driving growth in market cap. Conversely, restrictive regulations or uncertainty can lead to market cap declines as investors retreat【105†source】.

7. How is market cap different from fully diluted valuation (FDV)?

- Market Cap: Uses the circulating supply to calculate the value.

- FDV: Considers the total supply (including locked or unreleased tokens) to estimate the potential maximum value of a cryptocurrency【105†source】.

8. Why are stablecoins significant in the market cap rankings?

Stablecoins like USDT and USDC provide liquidity to the market and are widely used for trading and as a hedge against volatility. Their steady values contribute significantly to the market’s stability【105†source】【104†source】.

9. Can market cap predict the future price of a cryptocurrency?

Market cap provides a measure of size and popularity but does not guarantee future price performance. Other factors like utility, technological advancements, and market sentiment play critical roles【104†source】.

10. How can investors use market cap data effectively?

Investors use market cap data to:

- Compare the relative size of cryptocurrencies.

- Identify growth opportunities by analyzing smaller-cap coins with potential.

- Assess the risk level—larger caps are typically less volatile but have slower growth【105†source】.

For further reading and in-depth analysis, consult resources like FintechZoom, CoinMarketCap, and Investopedia.

This overview demonstrates FintechZoom’s critical role in providing comprehensive coverage of the cryptocurrency market. For additional information, you can explore FintechZoom’s official website and related resources【105†source】.

-

Blog7 months ago

Blog7 months agoMaria Taylor’s Husband: Jonathan Lee Hemphill’s Job, Family, and Kids Explained

-

SEO5 months ago

SEO5 months agoBest website platform for seo: top 5 popular websites, 1-book, 25 Top Free SEO Tools,

-

TECH7 months ago

TECH7 months agoiPhone 16 Pro Max VS iPhone 16 Pro: Features and Insights (2024-2025)

-

FASHION4 months ago

FASHION4 months agoOld-Fashioned: Styles Across Generation

-

SEO5 months ago

SEO5 months agoGoogle Ranking Factors: top 50 factors

-

SEO5 months ago

SEO5 months agoHow to Write an Article with AI: According to the google requirements ai article book

-

TECH7 months ago

TECH7 months ago2025 mercedes-benz c-class images:

-

TECH4 months ago

TECH4 months agoNew Innovations in Technology: The Future