FINANCE

What Are the Most Successful Small Businesses?

What Are the Most Successful Small Businesses? Starting a small business is always a bold and rewarding venture, but choosing the right niche can dramatically increase the odds of success. Some small businesses are thriving more than others due to growing demand, their ability to adapt to market trends, or offering desirable products or services. Here’s a look at some of the most successful small business industries, complete with examples and insights into why they thrive.

1. Online Retail Stores

E-commerce has seen explosive growth over the last decade, fueled by the convenience and accessibility it offers customers. Small business owners who focus on niche markets often find incredible success in this space, whether they sell handmade crafts, fitness equipment, or specialized apparel. Platforms like Shopify make it easier than ever to launch and manage an online store.

For example, Etsy has become a popular hub for small business retailers offering unique, handcrafted items. Numerous solo entrepreneurs have established successful small e-commerce businesses by leveraging platforms like this.

2. Personal Fitness and Wellness Services

From personal trainers to meditation coaches, fitness and wellness professionals are some of the most in-demand small business owners. With health awareness on the rise, more people are seeking wellness services and fitness guidance online and in person.

Businesses such as ClassPass allow independent fitness studios and trainers to reach clients. Providing niche services like Pilates classes, yoga, or one-on-one fitness programs is a proven tactic for building a loyal customer base.

3. Food Trucks

Food trucks are a prime example of small businesses operating with lower overhead while targeting food enthusiasts with creative concepts. These mobile eateries offer flexible restaurant models without long-term rent or maintenance costs. They’re especially successful in urban areas, local events, and busy parks.

Check out Roaming Hunger to see how food truck entrepreneurs have joined the culinary revolution by delivering unique dishes to neighborhoods across the country.

4. Digital Marketing Services

With companies of all sizes vying for online visibility, digital marketing agencies are booming. Services such as SEO optimization, social media management, and digital advertising are becoming essential for businesses that aim to grow and compete online.

For examples of thriving digital marketing companies, explore platforms like Upwork, where small business owners create specialized services for clients in areas ranging from content strategy to pay-per-click campaigns.

5. Pet Services and Products

Americans spend more money on their furry companions than ever before, making pet-related services a lucrative industry. Pet grooming, pet sitting, and specialty pet food are all areas where businesses have thrived.

Companies like Chewy have shown how small businesses can achieve success by offering top-quality products and exemplary customer service in the pet space.

6. Home Improvement and Cleaning Services

With more people working from home and spending more time in their living spaces, home improvement services are in demand. From remodeling to specialized cleaning services like carpet and window cleaning, this industry offers numerous opportunities for growth.

Sites such as Angi help connect skilled maintenance and cleaning professionals with homeowners in need of services.

7. Educational Tutoring and Online Courses

Education is another market experiencing strong demand, particularly in specialized tutoring or creating online courses. Parents seeking tutors for their children, or adults pursuing personal and professional development, are driving businesses in this niche.

Platforms like Udemy and VIPKid allow educators to capitalize on this trend by offering online classes for skill development and academic help.

8. Specialty Coffee Shops

Coffee remains one of the most consumed beverages globally, and specialty coffee shops with artisanal blends and cozy atmospheres are on the rise. They provide not only beverages, but also unique experiences, which create strong customer loyalty.

Businesses like Blue Bottle Coffee illustrate the potential to focus on high-quality coffee and foster community around the cafe experience.

9. Freelance Content Creation

The growing demand for online content has fueled the rise of freelance writers, graphic designers, and video editors. Small businesses in content creation thrive by taking advantage of a global client base and offering specialized services.

Platforms such as Fiverr and Canva empower creative individuals to run thriving freelance businesses by offering their skills to clients worldwide.

10. IT Support and Technology Services

With almost every business relying on technology, IT support and services for smaller enterprises are always in high demand. Whether offering cybersecurity solutions, cloud management, or customer tech support, IT services are indispensable for businesses looking to modernize.

Companies like Geek Squad demonstrate how small IT support businesses can tackle tech challenges for organizations that don’t have the resources to maintain in-house teams.

Related Books and URLs

Books

- “The Lean Startup” by Eric Ries: This book provides a methodological approach for entrepreneurs to build and manage startups, emphasizing the importance of innovation and adapting to market needs.

- “Crushing It!” by Gary Vaynerchuk: Vaynerchuk highlights how entrepreneurs can leverage digital platforms to create powerful personal brands and drive business success.

- “Shoe Dog” by Phil Knight: This memoir written by the co-founder of Nike offers insights into the challenges and triumphs of building a global business from the ground up.

URLs

- [Small Business Administration (SBA)](https://www.sba.gov/): Provides resources, guides, and support for small business owners to start and grow their businesses.

- Entrepreneur Magazine: Articles, news, and insights for entrepreneurs to stay informed about trends and strategies in business.

- HubSpot Blog: Offers marketing, sales, and customer service articles to help businesses improve their strategies and grow effectively.

- Score Mentors: Connects small business owners with volunteer mentors who can provide free advice and guidance on running a successful business.

FAQs

1. How do I start a small business?

Starting a small business involves several steps, including developing a business idea, creating a business plan, securing financing, choosing a business structure, and registering your business. For more detailed guidance, visit the [Small Business Administration (SBA)](https://www.sba.gov/) website for resources and support.

2. What are the most profitable small business ideas?

Some of the most profitable small business ideas include digital marketing services, IT support, specialty coffee shops, and freelance content creation. These sectors have shown high demand and growth potential. Learn more about current trends and opportunities at Entrepreneur Magazine.

3. How can I effectively market my small business?

Effective marketing strategies for small businesses involve utilizing digital marketing techniques such as SEO, social media, and content marketing. The HubSpot Blog offers valuable insights and articles on improving marketing strategies for growth.

4. Where can I find mentors for my small business?

Score Mentors connects small business owners with volunteer mentors for free advice and guidance.

5. How can technology help manage my small business?

Technology can streamline operations through tools for accounting, customer relationship management, and project management. It can also enhance your online presence and improve customer service. For the latest tech solutions, check out the services offered by Geek Squad.

FINANCE

Crypto-Legacy.App Software:Complete Guide

FINANCE

Should I Buy Bitcoin: in 2025? Complete Guide

A Historical Overview and Future Predictions

Should I Buy Bitcoin (BTC), the world’s first decentralized cryptocurrency, continues to attract investors worldwide as it evolves. Since its inception in 2009, Bitcoin has experienced remarkable highs and lows, leaving many to question its future trajectory. In this article, we explore Bitcoin’s historical performance, analyze its recent trends, and provide insights into whether investing in Bitcoin in 2025 is a wise decision.

A Brief History of Bitcoin

The Early Years (2009-2012):

Bitcoin was introduced in 2009 by an anonymous figure or group known as Satoshi Nakamoto. Initially valued at fractions of a cent, Bitcoin gained traction in 2010 when it was first used for a real-world transaction—10,000 BTC for two pizzas. By 2012, Bitcoin reached $13, as awareness and adoption began to grow.

First Boom and Bust (2013-2015):

Bitcoin experienced its first major price surge in 2013, skyrocketing to over $1,000. However, regulatory concerns and the collapse of the Mt. Gox exchange in 2014 caused the price to plummet below $300, highlighting the volatility of this emerging asset.

The 2017 Bull Run:

Bitcoin saw a meteoric rise in 2017, fueled by retail investor interest and growing adoption. Its price peaked near $20,000 in December 2017. However, a sharp correction followed in 2018, with Bitcoin falling to around $3,000 by the end of the year.

The 2020-2021 Explosion:

The COVID-19 pandemic in 2020 marked a turning point for Bitcoin, as institutional investors began to view it as a hedge against inflation. Bitcoin hit an all-time high of nearly $69,000 in November 2021, driven by mainstream adoption and significant investments from companies like Tesla and MicroStrategy.

The 2022 Crypto Winter:

Following its 2021 peak, Bitcoin faced significant challenges in 2022, including rising interest rates, economic uncertainty, and major industry scandals like the collapse of the FTX exchange. Bitcoin’s price fell below $16,000 at its lowest point.

Bitcoin in 2023-2024: Recovery and Consolidation

The crypto market began to stabilize in 2023 as macroeconomic conditions improved. Regulatory clarity in several regions, along with increasing institutional interest, pushed Bitcoin’s price above $35,000 by late 2023. Adoption grew further, with companies like BlackRock filing for Bitcoin spot ETFs, signaling mainstream acceptance.

By 2024, Bitcoin benefited from the hype surrounding its fourth halving event. The halving reduced the block reward from 6.25 BTC to 3.125 BTC, effectively lowering the rate of new Bitcoin issuance. Historically, halving events have preceded significant bull runs, as reduced supply creates scarcity in the market.

Predictions for Bitcoin in 2025

Factors Supporting Growth in 2025:

- Institutional Adoption:

Institutional participation in the Bitcoin market is expected to grow. Bitcoin ETFs and broader acceptance among hedge funds and asset managers could provide a steady influx of capital. - Inflation Hedge:

Amid global economic uncertainties, Bitcoin is increasingly viewed as “digital gold.” Its limited supply of 21 million coins ensures scarcity, making it a potential hedge against inflation. - Global Acceptance:

More countries may follow El Salvador’s example in adopting Bitcoin as legal tender. Blockchain technology’s increasing use in remittances and financial systems could drive demand further. - Technological Advancements:

Bitcoin’s Layer 2 solutions, like the Lightning Network, could improve transaction efficiency and scalability, making Bitcoin more appealing for everyday use.

Potential Risks in 2025:

- Regulatory Challenges:

Governments worldwide continue to grapple with regulating cryptocurrencies. Harsh regulatory actions in major economies could dampen Bitcoin’s growth. - Competition from Altcoins and CBDCs:

Alternative cryptocurrencies and Central Bank Digital Currencies (CBDCs) could compete with Bitcoin, particularly in the realm of payments and smart contracts. - Volatility:

Bitcoin’s price volatility remains a concern. While it presents opportunities for profit, it also increases risks for new investors.

Predicted Price Range for 2025:

Experts offer varied predictions for Bitcoin’s price in 2025, ranging from $100,000 to $250,000, assuming continued adoption and positive macroeconomic trends. However, some caution that a significant market downturn could see Bitcoin trading closer to $50,000.

Should You Buy Bitcoin in 2025?

Whether Bitcoin is a good investment in 2025 depends on your financial goals, risk tolerance, and investment strategy. Here are key points to consider:

- Long-Term Investment:

Bitcoin’s limited supply and growing institutional adoption make it an attractive long-term asset. Investors with a high-risk tolerance and a belief in Bitcoin’s future utility may find it worthwhile. - Diversification:

Bitcoin can serve as a diversification tool in a broader investment portfolio, balancing traditional assets like stocks and bonds. - Risk Management:

Due to its volatility, experts recommend allocating no more than 5-10% of your portfolio to Bitcoin.

Summary

Bitcoin’s journey from an obscure digital asset to a trillion-dollar market leader highlights its transformative potential. While the past demonstrates Bitcoin’s resilience, future success hinges on adoption, regulatory clarity, and technological advancements.

Investing in Bitcoin in 2025 could yield substantial rewards, but it comes with inherent risks. As with any investment, conducting thorough research and consulting with financial advisors is essential.

References

- Nakamoto, S. (2009). Bitcoin: A Peer-to-Peer Electronic Cash System.

- “Bitcoin Price History: A Timeline of Key Events.” Investopedia.

- “What to Expect from Bitcoin After the 2024 Halving.” CoinDesk.

- “Institutional Adoption of Bitcoin: 2025 Predictions.” Bloomberg.

- “The Role of Bitcoin in Diversified Portfolios.” Forbes.

Historical Performance: The Rollercoaster Ride

Bitcoin’s journey has been marked by incredible volatility. After its inception in 2009, Bitcoin’s value surged from less than $1 to nearly $20,000 in 2017. Following a severe correction, it rebounded, peaking at nearly $69,000 in late 2021 during the bull market. However, the 2022 bear market saw it dip below $20,000. By 2024, Bitcoin recovered dramatically, trading around $90,000 and nearing the $100,000 milestone【13】【14】.

Current Trends in 2024

- Institutional Adoption: The approval of spot Bitcoin ETFs in January 2024 significantly boosted institutional interest, with inflows exceeding $6 billion. Major players like BlackRock and Fidelity now offer Bitcoin-related financial products, contributing to mainstream adoption【13】【14】.

- Halving Impact: The April 2024 Bitcoin halving, which reduced mining rewards, historically triggers price surges by limiting supply. Analysts expect this event to be a key driver for 2025 price growth【14】【15】.

- Regulatory Environment: A more crypto-friendly U.S. administration under President-elect Donald Trump has bolstered optimism. Policies supporting Bitcoin adoption as a reserve asset could further solidify its role in global finance【13】【14】.

Expert Predictions for 2025

Predictions for Bitcoin’s price in 2025 vary widely:

- Bullish Projections: Analysts like Michael Saylor and Tim Draper foresee Bitcoin hitting $250,000 or more, citing increasing adoption and its scarcity-driven value proposition【13】【15】.

- Conservative Estimates: Institutions like Standard Chartered and Pantera Capital predict prices in the range of $115,000 to $200,000【14】【15】.

- Optimistic Scenarios: Some experts, including PlanB and Arthur Hayes, envision Bitcoin reaching $1 million under favorable economic and regulatory conditions【14】【15】.

Factors Influencing Bitcoin’s Future

- Macroeconomic Conditions: Rising inflation and concerns over fiat currency devaluation make Bitcoin an attractive hedge.

- Spot ETF Growth: Continued adoption of Bitcoin ETFs will likely attract more institutional investors.

- Regulatory Clarity: Supportive policies could pave the way for broader adoption, while restrictive ones may limit growth.

- Market Cycles: Bitcoin’s cyclical nature often leads to price spikes post-halving events【14】【15】.

Risks to Consider

- Volatility: Bitcoin remains highly volatile, and substantial price swings are expected.

- Regulatory Challenges: Unexpected restrictions in major markets could adversely impact Bitcoin’s growth.

- Market Saturation: Overreliance on institutional demand could lead to slower growth if demand plateaus【14】【15】.

Should You Buy Bitcoin?

Bitcoin’s strong fundamentals and growing institutional backing make it a compelling investment for 2025. However, its volatility and uncertain regulatory environment demand careful consideration. Diversifying your portfolio and consulting with a financial advisor are crucial before making a decision.

For more insights, explore detailed forecasts on platforms like CoinMarketCap and KuCoin.

Blog

fintechzoom.com crypto market cap: latest

Exploring the Crypto Market Cap Insights on FintechZoom.com

fintechzoom.com crypto market cap The cryptocurrency market has emerged as a key player in modern finance, with its market cap showcasing trends that attract both novice and seasoned investors. FintechZoom provides a detailed and analytical perspective on this rapidly evolving industry, focusing on market capitalization, regulatory challenges, and investment strategies.

The Current State of the Crypto Market

As of 2024, the global cryptocurrency market cap has exceeded $1.8 trillion, reflecting a compound annual growth rate (CAGR) of 11.1% since 2018. This surge is attributed to increasing institutional adoption, the rise of decentralized finance (DeFi), and growing interest in blockchain applications【104†source】【105†source】.

Key Features of FintechZoom’s Crypto Market Analysis

- Price and Market Analysis:

FintechZoom tracks price movements of leading cryptocurrencies like Bitcoin, Ethereum, and Cardano. Analysts delve into trends, enabling informed decision-making for traders and investors【104†source】【105†source】. - Blockchain Innovations:

Reports highlight advancements in blockchain technology, emphasizing its applications beyond cryptocurrency in sectors like healthcare, supply chain, and finance. - Regulatory Updates:

The site details global regulatory shifts affecting cryptocurrencies, such as the United States Securities and Exchange Commission (SEC)’s stance on token classifications and international tax reforms impacting crypto trading【105†source】. - Expert Insights:

Regular expert interviews provide nuanced views on market dynamics and strategic investment【104†source】.

Market Players and Trends

Top 10 Most Important Points About the Crypto Market Cap

- Definition and Significance

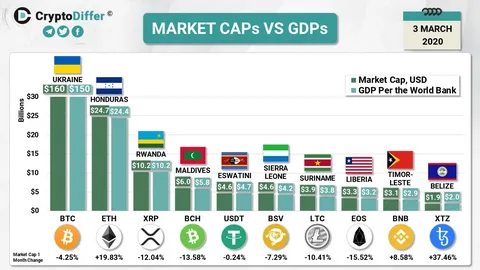

Crypto market capitalization is the total value of all cryptocurrencies in circulation. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. This metric provides insight into the overall size and health of the crypto market【104†source】【105†source】. - Market Leaders by Market Cap

Bitcoin (BTC) and Ethereum (ETH) dominate the market, accounting for over 60% of the total crypto market capitalization as of 2024. Their dominance reflects their widespread adoption and use cases【104†source】. - Volatility and Trends

Cryptocurrencies are highly volatile, with market caps fluctuating rapidly due to changes in investor sentiment, regulatory news, and macroeconomic factors. This volatility offers high-risk, high-reward opportunities for investors【105†source】. - Impact of Institutional Investment

Institutional investors are driving market growth, with Bitcoin ETFs and corporate investments into blockchain technology bolstering market capitalization. The approval of spot Bitcoin ETFs in early 2024 exemplifies this trend【105†source】. - Role of Decentralized Finance (DeFi)

DeFi applications, which allow users to borrow, lend, and trade without intermediaries, have significantly contributed to the market cap of cryptocurrencies like Ethereum and Solana【104†source】. - Regulatory Challenges and Adaptations

Regulatory clarity remains a pivotal factor influencing market cap. Countries with clear crypto regulations, such as Japan and Switzerland, have seen higher adoption rates and more stable market growth【105†source】. -

Correlation with Traditional Markets

Cryptocurrencies show lower correlation with traditional financial markets, making them an attractive asset class for diversification. This independence, however, also contributes to their volatility【105†source】. - Emergence of Stablecoins

Stablecoins like Tether (USDT) and USD Coin (USDC) are key players in the crypto market. Their market caps are growing due to their use in trading and as a store of value amid market volatility【105†source】. - Global Adoption Trends

Emerging economies are leading in crypto adoption, using digital currencies as alternatives to unstable fiat currencies. Countries like Nigeria and El Salvador are notable examples【104†source】. - Technological Advancements

Innovations in blockchain scalability, such as Ethereum’s transition to a proof-of-stake consensus mechanism, have positively influenced the market cap by attracting environmentally conscious investors and reducing energy consumption【105†source】.

References

- Crypto FintechZoom: Market Overview

- CoinMarketCap: Comprehensive Market Data

- Investopedia: Understanding Cryptocurrency Market Cap

These points highlight the dynamic nature of the cryptocurrency market and the factors influencing its market cap. For detailed insights, refer to resources like FintechZoom and CoinMarketCap.

| Category | Top Players | Description |

|---|---|---|

| Cryptocurrencies | Bitcoin, Ethereum, Solana | Leading assets by market capitalization. |

| Exchanges | Coinbase, Binance, Kraken | Platforms for buying, selling, and trading crypto. |

| Blockchain Firms | ConsenSys, Hyperledger | Innovators in blockchain infrastructure development. |

Challenges and Future Outlook

- Volatility: Cryptocurrency markets are known for extreme price swings, presenting both opportunities and risks for investors.

- Regulation: Inconsistent global regulatory frameworks create uncertainty for users and businesses【105†source】.

- Adoption: Emerging markets are experiencing rapid adoption, driven by decentralized applications and accessibility.

Latest Research and Expert Verdicts

Recent research emphasizes the impact of regulatory clarity on market stability. Analysts forecast further institutional adoption if regulatory challenges are addressed effectively. Financial experts suggest that diversification within crypto portfolios and cautious investment in tokenized assets can mitigate risks while capitalizing on growth opportunities【105†source】.

Detailed FAQs About the Crypto Market Cap

1. What is crypto market cap, and why is it important?

The cryptocurrency market cap is the total value of a cryptocurrency or the entire market. It is calculated by multiplying the price of a cryptocurrency by its circulating supply. It provides a snapshot of the market’s size and health, helping investors compare different cryptocurrencies and track growth over time【104†source】【105†source】.

2. What is the difference between circulating supply and total supply?

- Circulating Supply: The number of coins or tokens actively available in the market.

- Total Supply: The total amount of coins or tokens that exist, including those not yet released or locked.

The market cap is typically calculated using the circulating supply, as it reflects the available tradable value of a cryptocurrency【105†source】.

3. How does the crypto market cap compare to traditional markets?

The global crypto market cap is smaller than traditional markets like stocks or bonds. However, its growth rate is significantly higher due to innovations in blockchain technology and increasing adoption by both retail and institutional investors【105†source】【104†source】.

4. Which cryptocurrencies have the highest market caps?

As of 2024, Bitcoin (BTC) and Ethereum (ETH) lead the market, followed by stablecoins like Tether (USDT) and altcoins like Binance Coin (BNB) and Solana (SOL)【105†source】.

5. What factors influence the market cap of a cryptocurrency?

Several factors impact market capitalization, including:

- Price fluctuations.

- Adoption rates and utility of the cryptocurrency.

- Supply dynamics, including token burns or minting.

- Investor sentiment and market trends【105†source】【104†source】.

6. What is the impact of regulatory changes on market cap?

Regulatory clarity can boost market confidence, encouraging investment and driving growth in market cap. Conversely, restrictive regulations or uncertainty can lead to market cap declines as investors retreat【105†source】.

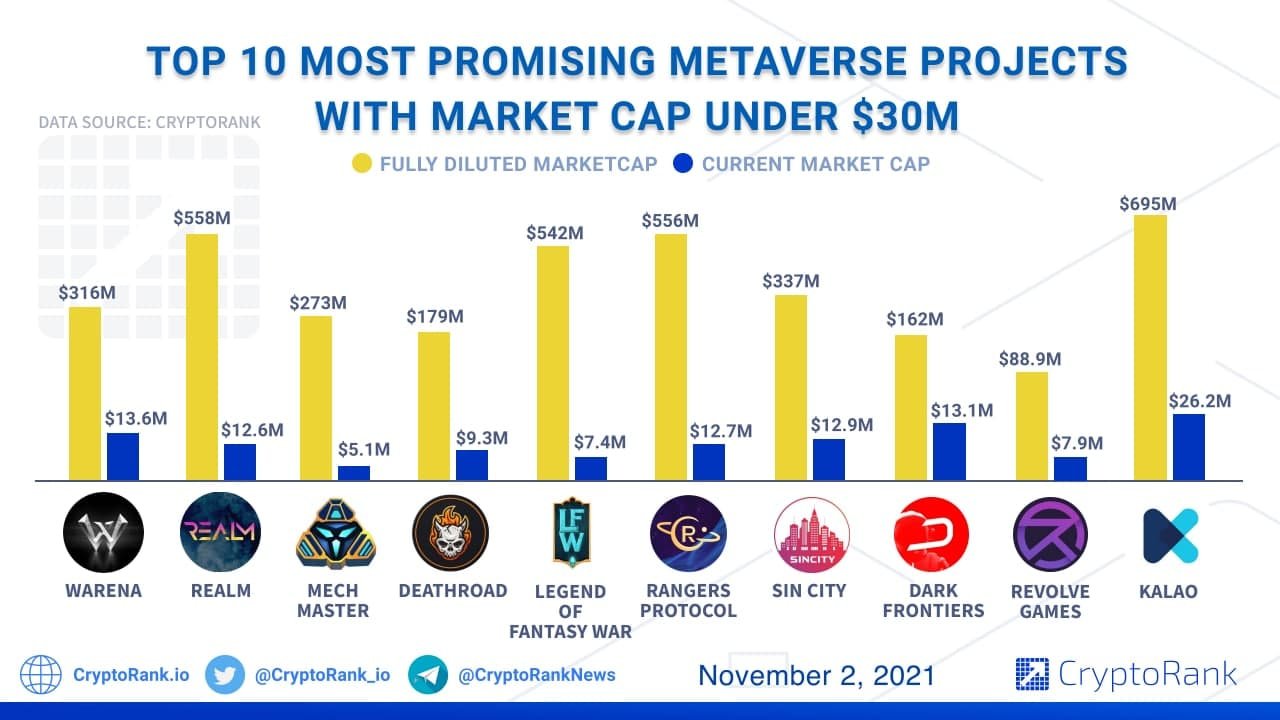

7. How is market cap different from fully diluted valuation (FDV)?

- Market Cap: Uses the circulating supply to calculate the value.

- FDV: Considers the total supply (including locked or unreleased tokens) to estimate the potential maximum value of a cryptocurrency【105†source】.

8. Why are stablecoins significant in the market cap rankings?

Stablecoins like USDT and USDC provide liquidity to the market and are widely used for trading and as a hedge against volatility. Their steady values contribute significantly to the market’s stability【105†source】【104†source】.

9. Can market cap predict the future price of a cryptocurrency?

Market cap provides a measure of size and popularity but does not guarantee future price performance. Other factors like utility, technological advancements, and market sentiment play critical roles【104†source】.

10. How can investors use market cap data effectively?

Investors use market cap data to:

- Compare the relative size of cryptocurrencies.

- Identify growth opportunities by analyzing smaller-cap coins with potential.

- Assess the risk level—larger caps are typically less volatile but have slower growth【105†source】.

For further reading and in-depth analysis, consult resources like FintechZoom, CoinMarketCap, and Investopedia.

This overview demonstrates FintechZoom’s critical role in providing comprehensive coverage of the cryptocurrency market. For additional information, you can explore FintechZoom’s official website and related resources【105†source】.

-

Blog4 months ago

Blog4 months agoMaria Taylor’s Husband: Jonathan Lee Hemphill’s Job, Family, and Kids Explained

-

SEO2 months ago

SEO2 months agoBest website platform for seo: top 5 popular websites, 1-book, 25 Top Free SEO Tools,

-

Blog1 month ago

Blog1 month agoSigns of a Healthy Relationship:

-

FASHION3 weeks ago

FASHION3 weeks agoOld-Fashioned: Styles Across Generation

-

TECH4 weeks ago

TECH4 weeks agoRadiology Tech: Prices, Features, and Buy

-

YOGA4 weeks ago

YOGA4 weeks agoDental Care: Can Increase Your Life Expectancy

-

Blog1 month ago

Blog1 month agobest organic foods: for all

-

SEO2 months ago

SEO2 months agoGoogle Ranking Factors: top 50 factors